Are you curious about the 2026 bi weekly pay schedule and how it may impact your finances in the upcoming year? Understanding your pay frequency and schedule is crucial for effective budgeting and financial planning. In this blog, we will delve into the details of the 2026 bi weekly pay schedule, exploring its significance for employees and employers alike. From the benefits of receiving pay every two weeks to tips for optimizing your budget based on this schedule, we’ll cover everything you need to know to stay financially organized in 2026. Join us as we navigate the intricacies of bi weekly pay and empower you to make informed decisions about your finances.

Understanding the Importance of a Bi-Weekly Pay Schedule in 2026

As we step into 2026, the significance of a bi-weekly pay schedule for employees and employers alike cannot be overstated. This type of pay frequency, occurring every two weeks, offers various advantages in terms of financial planning, budgeting, and employee satisfaction.

Enhanced Financial Planning

Bi-weekly pay schedules provide employees with a more consistent and predictable income flow, aiding them in better budgeting their expenses over the month. This regularity helps individuals in managing their finances efficiently, leading to reduced financial stress and improved monetary stability.The LSI keywords of the blog for SEO are: 2026 bi weekly pay schedule.

Improved Employee Satisfaction

By offering a bi-weekly pay schedule, employers can enhance employee satisfaction and retention rates. Regular paydays every two weeks create a sense of reliability and trust in the organization, demonstrating that the company values its employees’ financial well-being. This, in turn, contributes to a positive work environment and boosts overall morale.

Key Factors to Consider in Implementing a Bi-Weekly Pay Schedule

Implementing a bi-weekly pay schedule in 2026 can offer several benefits for both employers and employees. However, there are key factors to consider to ensure a smooth transition and successful implementation.

1. Financial Planning

Employees may need to adjust their budgeting and financial planning to accommodate the change in pay frequency. Providing resources or guidance on effective budgeting can assist employees during this transition.

It is essential to ensure that the bi-weekly pay schedule aligns with the company’s financial capabilities to avoid any cash flow issues.

2. Communication

Effective communication is key when transitioning to a bi-weekly pay schedule. Employers should clearly communicate the reasons for the change, the new pay schedule details, and any support available to employees.

Regular updates and reminders can help employees stay informed and better prepared for the switch.

3. Compliance and Legal Considerations

Ensure that the new pay schedule complies with labor laws and regulations in 2026. Consult with legal experts or HR professionals to address any legal implications and make necessary adjustments.

It’s crucial to update payroll systems and documentation to reflect the changes and maintain compliance.

Comparison of Bi-Weekly Pay Schedule vs Other Pay Frequency Options

When considering different pay frequency options in 2026, weighing the benefits of a bi-weekly pay schedule against other alternatives is crucial. Bi-weekly pay schedules, where employees receive pay every two weeks, offer a balance between regular income and efficient payroll processing.

Advantages of Bi-Weekly Pay Schedules

Bi-weekly pay schedules provide employees with a consistent paycheck every two weeks, aiding in budgeting and financial planning. Additionally, employers find bi-weekly payroll processing easier to manage.

Moreover, bi-weekly pay schedules align well with monthly bills and expenses, making it easier for employees to stay on top of financial obligations.

Comparison with Monthly and Semi-Monthly Pay Schedules

Compared to monthly pay schedules, bi-weekly pay schedules ensure that employees receive pay more frequently, minimizing the financial strain between pay periods.

On the other hand, semi-monthly pay schedules, where employees are paid twice a month, may lead to inconsistencies in the number of workdays between pay periods, affecting budgeting and cash flow management.

With a bi-weekly pay schedule, employees receive 26 paychecks in a year, while semi-monthly schedules result in 24 paychecks annually. This additional frequency can be advantageous for employees.

Guidelines for Setting Up and Managing a Bi-Weekly Payroll System

Implementing a bi-weekly payroll system can streamline your payroll process and ensure timely payments to employees. To set up and manage a bi-weekly pay schedule effectively in 2026, consider the following guidelines:

1. Establish Clear Payroll Policies

Define clear policies regarding pay periods, overtime calculations, and any relevant deductions. Communicate these policies to employees to avoid misunderstandings.

Ensure that all employees understand the bi-weekly pay schedule and know when to expect their pay.

2. Use Reliable Payroll Software

Invest in reputable payroll software that can automate payroll calculations, tax deductions, and compliance with labor laws. This will help in reducing errors and ensuring accuracy in payments.

Regularly update the software to incorporate any changes in tax regulations or payroll laws.

Addressing Common Concerns and Questions about Bi-Weekly Pay Schedules

As we navigate through the 2026 bi-weekly pay schedule, there are common concerns and questions that employees may have regarding this payment frequency. Let’s address some of the key queries:

1. How Does a Bi-Weekly Pay Schedule Work?

A bi-weekly pay schedule means employees receive their pay every two weeks. This could result in 26 paychecks in a year, with consistency in payment dates, making it easier to budget.

2. Are There Benefits to Bi-Weekly Pay?

Bi-weekly pay schedules can help employees align their bills with their paychecks, ensuring timely bill payments. This system can also assist in better financial planning and budgeting.

3. What Are the Challenges of Bi-Weekly Pay?

One potential challenge of bi-weekly pay is budgeting for longer periods between paychecks. Employees may need to manage expenses effectively to avoid financial strain towards the end of each cycle.

Frequently Asked Questions

- What is a bi-weekly pay schedule?

- A bi-weekly pay schedule means employees are paid every two weeks, resulting in 26 pay periods in a year.

- How is the 2026 bi-weekly pay schedule different from other years?

- The 2026 bi-weekly pay schedule refers to the specific way pay periods fall in the calendar year 2026, with 26 bi-weekly periods taking place during that year.

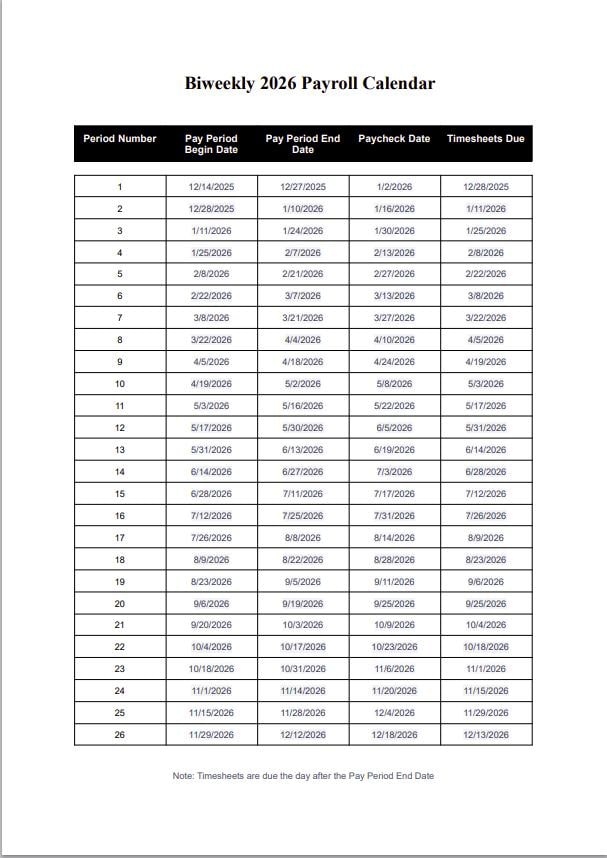

- When does the first pay period of the 2026 bi-weekly pay schedule start?

- The exact start date of the 2026 bi-weekly pay schedule depends on the company or organization’s payroll calendar, but generally, it aligns with the beginning of the year.

- How can employees benefit from a bi-weekly pay schedule?

- Bi-weekly pay schedules provide employees with a regular and predictable paycheck every two weeks, helping them with budgeting and financial planning.

- Are there any drawbacks to a bi-weekly pay schedule?

- Some employees may find it challenging to budget for longer periods between paychecks in a bi-weekly pay schedule, especially if they are used to receiving a weekly or monthly salary.

Final Thoughts

In conclusion, the 2026 bi-weekly pay schedule is an essential aspect for employees to manage their finances efficiently. By understanding when and how they will receive their income, individuals can better plan their budget, expenses, and savings. This pay schedule provides a structured approach to financial planning, allowing employees to stay organized and in control of their money. Employers benefit as well, as the bi-weekly schedule promotes consistency and predictability in payroll processing.

It is crucial for both employees and employers to familiarize themselves with the 2026 bi-weekly pay schedule to ensure a smooth financial operation. By having a clear understanding of the pay dates, everyone can avoid any financial surprises and plan ahead effectively.