Are you prepared for the changes coming with the 2026 Form 941 Schedule B? Stay ahead of the game and understand the implications of this form update. The 2026 Form 941 Schedule B holds crucial information for employers regarding their tax liabilities and credits. This update may bring new requirements and guidelines that could impact your tax reporting process. In this blog, we will delve into the specifics of the 2026 form 941 Schedule B, highlighting what you need to know to navigate this update smoothly. Stay informed and ensure compliance by learning about the key components of the 2026 Form 941 Schedule B.

Introduction to Form 941 Schedule B

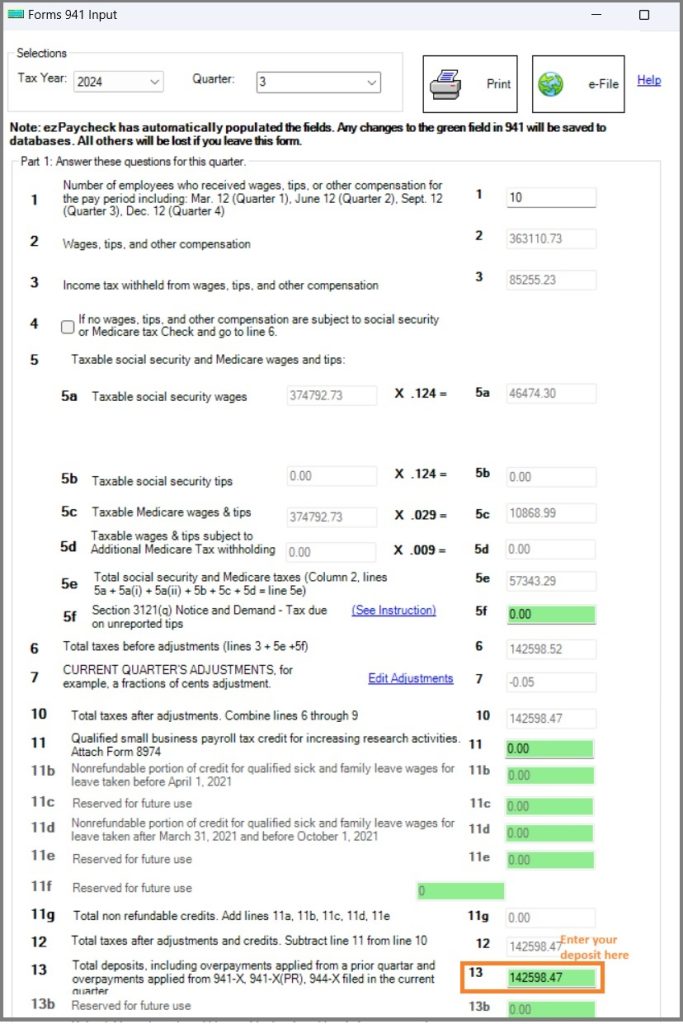

Form 941 Schedule B is a necessary component of Form 941, which is used by employers to report quarterly taxes. Specifically, Schedule B is utilized to provide additional details regarding the tax liability for federal income tax withheld from employees. It is crucial for employers to accurately fill out this section to ensure compliance with tax regulations and avoid penalties.

Importance of Form 941 Schedule B

Form 941 Schedule B plays a vital role in the accurate reporting of federal income tax liabilities. It allows employers to reconcile the total amount of federal income tax withheld from employees with the deposits made throughout the quarter. This reconciliation is essential for verifying that the correct amount of taxes has been remitted to the IRS on behalf of employees.

Completing Form 941 Schedule B

Employers should carefully review the information provided on Form 941 Schedule B to ensure accuracy. This includes entering the total number of employees, the total amount of federal income tax withheld, and any adjustments or corrections that need to be made. Additionally, employers must calculate the total tax liability and ensure that it matches the deposits made during the quarter.

It is recommended to double-check all calculations and details before submitting Form 941 Schedule B to avoid errors and potential penalties. Employers should keep detailed records of federal income tax withholdings and deposits to facilitate the accurate completion of this form.

Understanding the Purpose of Form 941 Schedule B

Form 941 Schedule B for the year 2026 is crucial for businesses as it helps in reconciling the total tax liability reported on Form 941. This form provides detailed information regarding the tax liability by breaking down the federal tax deposit made by the employer. It ensures that the total tax deposits match the amounts reported on Form 941.

Importance of Form 941 Schedule B

Form 941 Schedule B is essential for businesses to ensure accuracy in their tax reporting and compliance. It helps in reconciling tax deposits with the reported amounts on Form 941, reducing the risk of discrepancies and potential penalties.

Completing Form 941 Schedule B

Employers need to fill out Form 941 Schedule B by providing detailed information on their tax deposits for each month. They should accurately report the total tax liability and deposits made to avoid any errors during the reconciliation process.

- Enter the total tax liability for each deposit period.

- Report the amounts deposited and the dates of each deposit.

- Calculate the total deposits and compare them to the total tax liability.

Key Components of Form 941 Schedule B for 2026

Form 941 Schedule B is an essential component of the overall Form 941 for the year 2026. It details the total tax liability and deposits made by the employer throughout the year, providing a comprehensive overview of payroll taxes.

Employer Identification Information

The schedule typically starts with employer identification details such as name, address, and EIN (Employer Identification Number). Ensuring accurate information here is crucial for proper tax reporting.

Quarterly Tax Liability Breakdown

This section outlines the breakdown of tax liabilities for each quarter of the year. It includes details on federal income tax withheld, social security tax, and Medicare tax, among others.

- Q1: $XX,XXX

- Q2: $XX,XXX

- Q3: $XX,XXX

- Q4: $XX,XXX

Deposits and Payment Records

This part of Schedule B includes information on the dates and amounts of tax deposits made by the employer throughout the year. It showcases compliance with tax deposit requirements.

Employers should ensure that the information provided in this section aligns with their payment records to avoid discrepancies.

How to Fill Out Form 941 Schedule B

Filling out Form 941 Schedule B is a crucial part of the tax reporting process for employers. Schedule B is used to report the tax liability for semi-weekly schedule depositors, providing essential information about tax liabilities and deposits made. Here’s a guide on how to fill out Form 941 Schedule B for the year 2026.

1. Reporting Tax Liability

Enter the total tax liability for the quarter, including federal income tax, social security tax, and Medicare tax, for each payday in the quarter.

Ensure that the total tax liability matches the amounts reported on Form 941 for each corresponding quarter.

2. Calculating Tax Deposits

Calculate the total tax deposits made for the quarter, including deposits made timely and any overpayments or underpayments.

Tip: Use the Electronic Federal Tax Payment System (EFTPS) for convenient and secure tax deposits.

3. Completing Schedule B

Fill out Schedule B accurately with the calculated tax liability and tax deposits information for each payday in the quarter.

Make sure to double-check all entries to avoid discrepancies that could result in penalties or additional taxes.

Importance of Form 941 Schedule B for Businesses

Form 941 Schedule B is a crucial document for businesses that hire employees and are required to withhold federal income tax, social security tax, and Medicare tax from employee wages. It serves as a record of the tax liabilities and payments made throughout the year. This form is typically filed quarterly along with Form 941 to report these withholdings to the IRS.

Compliance with Tax Regulations

By accurately completing Form 941 Schedule B, businesses ensure compliance with federal tax regulations. Failing to report and remit payroll taxes correctly can lead to penalties and legal consequences.

It is important for businesses to review and reconcile the information in Schedule B with their payroll records to avoid errors or discrepancies.

Documentation and Record-Keeping

Form 941 Schedule B also serves as essential documentation for businesses regarding their payroll tax obligations. It helps maintain accurate records of employee wages, tax withholdings, and employer contributions.

Having detailed and organized records can facilitate audits, inquiries, or reviews by tax authorities, ensuring transparency and accountability in financial reporting.

Common Mistakes to Avoid When Filing Form 941 Schedule B

When filing Form 941 Schedule B for the year 2026, there are several common mistakes that employers should be aware of in order to ensure accurate reporting and compliance with IRS regulations. One of the key errors to avoid is incorrect reporting of total tax liability, which can lead to penalties and fines. It is essential to double-check all calculations and ensure that the amounts entered on Schedule B match the corresponding figures on Form 941.

Incorrect Identification of the Reporting Quarter

Misidentifying the reporting quarter can result in discrepancies in tax reporting. Ensure that the quarter indicated on Schedule B aligns with the correct timeframe to prevent errors in tax calculations and reporting.

Missing or Incomplete Employee Information

Failure to provide accurate and complete employee information, such as social security numbers or wage details, can lead to inaccuracies in tax reporting. It is crucial to verify that all employee data is entered correctly to avoid potential penalties.

Failure to Submit Schedule B Timely

Submitting Schedule B past the deadline can result in penalties and interest charges. Employers must ensure that Schedule B is filed on time to avoid these additional costs and maintain compliance with IRS regulations.

Tips for Efficiently Handling Form 941 Schedule B

Handling Form 941 Schedule B efficiently is crucial for proper tax reporting and compliance. Here are some tips to help you navigate this process smoothly in 2026:

Understand the Form Requirements

Before filling out Schedule B, make sure you understand the requirements and guidelines provided by the IRS for the specific year 2026. Familiarize yourself with the information needed to accurately complete the form.

Ensure that you have the correct details of your employee wages, taxes withheld, and other necessary information to avoid discrepancies.

Organize Your Data

Organizing your data is key to efficiently handling Form 941 Schedule B. Create a system to track and store your payroll information throughout the year. Use software or spreadsheets to stay organized.

Keep all relevant records and documents in one place to simplify the process when it’s time to fill out Schedule B at the end of each quarter.

Review for Accuracy

Before submitting Form 941 Schedule B for the year 2026, it’s essential to review the information you’ve provided for accuracy.

- Double-check all figures and calculations to ensure there are no errors.

- Verify that the information matches your payroll records to avoid discrepancies or penalties.

- Ensure that you’ve included all necessary details required by the IRS for that specific year.

Frequently Asked Questions

- What is Form 941 Schedule B?

- Form 941 Schedule B is a supplemental schedule that may be required to be filed along with Form 941, which is the Employer’s Quarterly Federal Tax Return. It provides additional information about the tax liability for semiweekly schedule depositors.

- When is Form 941 Schedule B used?

- Form 941 Schedule B is used by employers who are semiweekly schedule depositors and need to report their tax liability for the payroll taxes, including federal income tax withheld from employees’ wages, Social Security and Medicare taxes.

- Do all employers need to file Form 941 Schedule B?

- No, not all employers need to file Form 941 Schedule B. It is specifically required for semiweekly schedule depositors who have a certain amount of tax liability for payroll taxes. Employers should refer to the IRS guidelines to determine if they need to file this form.

- What information is included in Form 941 Schedule B?

- Form 941 Schedule B includes detailed information about the tax liability for semiweekly schedule depositors, such as the dates of tax liability for each semiweekly period, the total liability for federal income tax, Social Security tax, and Medicare tax, as well as any adjustments or corrections.

- Where can I get Form 941 Schedule B?

- Form 941 Schedule B can be obtained from the official website of the IRS (Internal Revenue Service). Employers can download the form, along with instructions for filling it out, from the IRS website or contact the IRS for assistance.

Final Thoughts

In conclusion, understanding the 2026 Form 941 Schedule B is crucial for employers to accurately report their federal tax liabilities. This schedule provides a breakdown of tax liabilities for each month, helping businesses stay compliant with IRS requirements. By accurately filling out Schedule B, employers can avoid penalties and ensure that their employees’ taxes are properly reported and paid. It is essential to stay updated on any changes to tax forms and regulations to avoid any potential issues. Therefore, thorough knowledge and compliance with the 2026 Form 941 Schedule B are key for successful tax reporting and overall business operations.