As we look forward to the year 2026, it’s essential to stay informed about the upcoming changes in the tax landscape. One crucial aspect to keep an eye on is the 2026 tax rate schedule, which outlines the tax brackets and rates that will apply to different income levels. Understanding this schedule is vital for individuals, businesses, and tax professionals to effectively plan and strategize for the future.

The 2026 tax rate schedule will have a significant impact on how much individuals and businesses will owe in taxes, so being prepared and knowledgeable about these upcoming changes is key. In this blog, we will delve into the details of the 2026 tax rate schedule, explore the potential implications, and provide insights to help you navigate through the evolving tax landscape.

Introduction to the 2026 Tax Rate Schedule

As we look forward to the year 2026, understanding the tax rate schedule for that year is crucial for financial planning and compliance. The 2026 tax rate schedule determines the percentage at which your income will be taxed by the government. It is essential to stay informed about any updates or changes in the tax rates to effectively manage your finances.

Key Changes in the 2026 Tax Rate Schedule

The 2026 tax rate schedule may introduce new income brackets and adjustments to existing tax rates. It is important to stay updated on these changes to plan your finances effectively. 2026 tax rate schedule adjustments can impact how much tax you owe or receive as a refund.

Impact on Different Income Levels

For individuals with varying income levels, the 2026 tax rate schedule will have different implications. Higher income earners may fall into a higher tax bracket, while those with lower incomes could benefit from lower tax rates. Understanding how these changes affect your specific income level is essential for financial decision-making.

Understanding the Changes in Tax Rates

As we delve into the 2026 tax rate schedule, it is crucial to comprehend the alterations in tax rates that could impact individuals and businesses. The tax rates set for the year 2026 reflect the latest adjustments made by the government to ensure fair taxation and revenue generation.

Impact on Individual Taxpayers

Individual taxpayers will experience varying tax rates based on their income levels. The 2026 tax rate schedule introduces new brackets and rates, influencing how much individuals owe in taxes. It is vital for taxpayers to understand these changes to accurately calculate their tax liabilities.

Changes for Business Entities

Businesses are also affected by the adjustments in tax rates for 2026. These modifications can impact the bottom line of companies, influencing decisions related to investments, expenses, and overall financial planning. It is essential for businesses to adapt to these changes to optimize their tax strategies and remain compliant with the law.

Implications of the 2026 Tax Rate Schedule

The 2026 tax rate schedule has significant implications for individuals and businesses alike. Understanding these implications can help in financial planning and decision-making.

Changes to Tax Brackets

One of the key implications of the 2026 tax rate schedule is the potential changes to tax brackets. Adjustments to income thresholds can impact how much individuals owe in taxes.

Being aware of these changes can help individuals make strategic decisions regarding their income and savings.

Impact on Small Businesses

The 2026 tax rate schedule may also have implications for small businesses. Changes in corporate tax rates can affect profitability and expansion plans.

Understanding the new tax rates can help small business owners optimize their financial strategies and stay compliant with the law.

Strategies for Tax Planning under the New Rates

As per the 2026 tax rate schedule, taxpayers should consider implementing effective tax planning strategies to optimize their financial position. Here are some key strategies to navigate through the new tax rates:

Utilize Tax-Advantaged Accounts

One effective strategy is to maximize contributions to tax-advantaged accounts such as Individual Retirement Accounts (IRAs) and Health Savings Accounts (HSAs). These accounts offer tax benefits that can help reduce taxable income.

Take Advantage of Deductions and Credits

Identify all available deductions and credits that you qualify for to lower your tax liability. This includes deductions for mortgage interest, charitable donations, and education expenses. Utilizing tax credits such as the Child Tax Credit can also lead to significant tax savings.

Consider Tax-Loss Harvesting

For investors, tax-loss harvesting involves selling investments that have experienced a loss to offset gains and reduce taxable income. This strategy can be particularly useful in managing capital gains taxes efficiently.

Consult with a Tax Professional

Seeking guidance from a tax professional can help you navigate the complexities of the tax code and identify personalized strategies to optimize tax planning. A tax advisor can provide valuable insights and recommendations tailored to your specific financial situation.

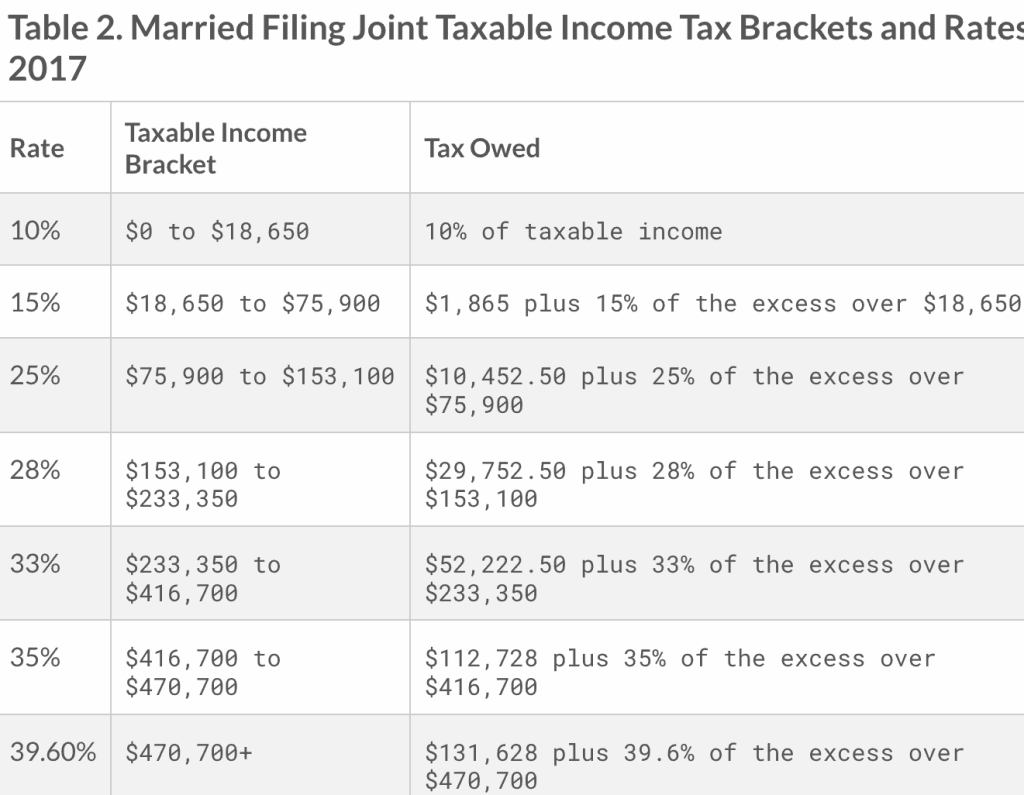

Comparing the 2026 Tax Rate Schedule with Previous Years

As we delve into the 2026 tax rate schedule, it is essential to compare it with previous years to understand the changes and implications. The tax rates set for 2026 play a crucial role in determining the amount of tax individuals and businesses need to pay based on their income levels. Let’s explore how the 2026 tax rates differ from those of the past years.

Changes in Income Tax Brackets

The 2026 tax rate schedule introduces revised income tax brackets that might impact taxpayers differently compared to previous years. It is important to familiarize yourself with these new brackets to ensure accurate tax filings.

Adjustments in Deductions and Credits

Along with changes in tax brackets, the 2026 schedule might bring modifications to deductions and credits available to taxpayers. These adjustments can influence the overall tax liability and should be taken into consideration during tax planning.

Potential Challenges and Opportunities

When considering the 2026 tax rate schedule, there are various potential challenges and opportunities that individuals and businesses may face. One of the main challenges could be the complexity of the new tax brackets and rates introduced for that specific year. Taxpayers may find it challenging to navigate the changes and ensure compliance with the updated regulations.

Increased Compliance Requirements

With any new tax rate schedule, there is an increased need for accurate record-keeping and documentation. This could lead to additional resources needed to manage tax filings effectively. Businesses may need to invest in upgraded accounting systems to meet the new requirements.

Opportunities for Tax Planning

On the flip side, the new tax rate schedule may present opportunities for tax planning. Individuals and businesses can strategize to take advantage of deductions, credits, and incentives that align with the updated tax brackets. Consulting with a tax professional could help uncover potential savings.

Analysis of Tax Rate Schedule in Different Scenarios

When examining the 2026 tax rate schedule, it’s crucial to consider various scenarios that could impact tax obligations. Understanding how different factors may influence tax rates can help individuals and businesses make informed financial decisions.

Impact of Economic Growth

The tax rate schedule for 2026 could be influenced by the overall economic growth of the country. A robust economy may lead to adjustments in tax rates to maintain fiscal stability. On the other hand, a downturn in the economy might result in tax cuts to stimulate growth.

Changes in Legislation

Legislative changes can significantly impact tax rates. New laws or amendments to existing tax codes could alter the tax rate schedule for 2026. Staying informed about potential legislative updates is crucial for accurate tax planning.

Frequently Asked Questions

- What is the 2026 tax rate schedule?

- The 2026 tax rate schedule refers to the tax brackets and corresponding tax rates that individuals will be subject to for the tax year 2026.

- How are tax rates determined for the 2026 tax rate schedule?

- Tax rates for the 2026 tax rate schedule are determined by the Internal Revenue Service (IRS) based on income levels and tax brackets set by the government.

- Are there any changes in the tax rates for 2026 compared to previous years?

- Tax rates for 2026 may change from previous years due to adjustments for inflation and changes in tax laws. It is recommended to consult the most recent tax rate schedule for accurate information.

- Where can I find the 2026 tax rate schedule?

- The IRS publishes the official tax rate schedule for each tax year on their website. You can also consult tax professionals or resources for information on the 2026 tax rates.

Wrapping Up the 2026 Tax Rate Schedule

As we conclude our exploration of the 2026 tax rate schedule, it is evident that staying informed about tax laws and rates is essential for effective financial planning. The detailed breakdown of tax brackets provided for 2026 sheds light on how individuals and businesses can assess and optimize their tax liabilities. By understanding the nuances of the tax system, taxpayers can make informed decisions to minimize their tax burden legally and ethically.

Remember, keeping abreast of changes in tax rates and regulations can empower you to take proactive steps to manage your finances efficiently. So, make sure to consult with tax professionals and utilize available resources to navigate the complexities of the 2026 tax rate schedule.