As we approach 2026, it’s essential for taxpayers to familiarize themselves with the upcoming changes in tax rates. The 2026 tax rate schedules outline the rates at which individuals and businesses will be taxed on their income. These schedules play a crucial role in determining how much tax each entity owes to the government based on their earnings. By staying informed about the 2026 tax rate schedules, individuals can plan their finances effectively and make informed decisions to optimize their tax liabilities.

This blog will delve deeper into the intricacies of the 2026 tax rate schedules, highlighting key changes and implications for taxpayers. Understanding these schedules can empower individuals and businesses to navigate the tax landscape efficiently and mitigate any potential financial burdens.

Understanding Tax Rate Schedules

When it comes to navigating the complexities of tax systems, understanding tax rate schedules is crucial to managing your finances effectively. The 2026 tax rate schedules outline the various tax brackets and the corresponding rates applicable for the tax year 2026.

What are Tax Rate Schedules?

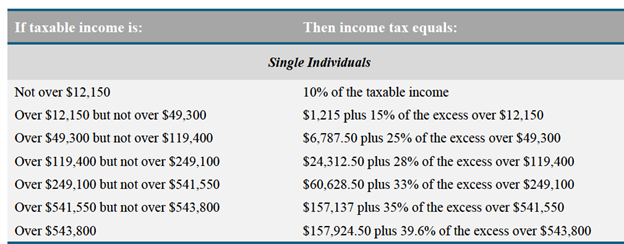

Tax rate schedules are tables that illustrate the marginal tax rates applicable to different levels of taxable income. These schedules help individuals and businesses calculate the amount of tax they owe based on their income.

Why are Tax Rate Schedules Important?

Understanding tax rate schedules is crucial for proper tax planning. By knowing which tax bracket your income falls into, you can make informed decisions to minimize your tax liability through deductions and credits.

It’s crucial to stay updated with the latest tax rate schedules to ensure accurate tax filings and avoid penalties for underpayment.

Changes in Tax Rates for 2026

As we look ahead to the tax landscape of 2026, it’s essential to stay informed about the latest changes in tax rates that may impact individuals and businesses. Understanding these changes can help individuals plan their financial strategies more effectively.

New Tax Brackets

In 2026, the tax brackets are adjusted to account for inflation. This means that income thresholds for each tax bracket may change compared to the previous year.

Example: The taxable income range for the 22% tax bracket may shift from $40,526 – $86,375 in 2025 to $41,000 – $87,000 in 2026.

Changes in Deductions and Credits

There could be modifications to deductions and credits available in 2026. Taxpayers should be aware of any changes in standard deductions, itemized deductions, or tax credits to optimize their tax savings.

Keep in mind: Tax laws are subject to change, so staying updated is crucial for maximizing tax benefits.

Impact of Tax Rate Changes

The adjustments in tax rates for 2026 can significantly impact individuals and businesses, influencing decisions related to investments, retirement planning, and overall financial management.

Being proactive: Consult with a tax professional to understand how these changes can affect your specific tax situation.

Impact of Tax Rate Schedules on Different Income Levels

Understanding the 2026 tax rate schedules is crucial for individuals at various income levels as it directly affects how much tax they owe to the government. The tax rate schedules for 2026 determine the percentage of income that individuals need to pay as taxes based on their taxable income brackets.

Low Income Levels

For individuals with lower income levels in 2026, the tax rate schedules often show lower tax rates or even exemptions for some income thresholds. This helps in reducing the overall tax burden on individuals who earn less.

Mid Income Levels

Those in the mid-income range face varying tax rates depending on their specific income brackets. The 2026 tax rate schedules may show moderate tax rates for this group, ensuring that individuals contribute their fair share based on their income.

High Income Levels

Individuals with higher income levels often fall into higher tax brackets according to the 2026 tax rate schedules. This means they could be subject to higher tax rates, reflecting a progressive tax system where those who earn more contribute a larger portion of their income in taxes.

Planning Strategies Based on 2026 Tax Rate Schedules

As we analyze the 2026 tax rate schedules, it is crucial for individuals and businesses to devise effective planning strategies to optimize their tax obligations. Understanding the tax brackets, deductions, and credits available in 2026 can significantly impact financial decisions.

Maximizing Deductions and Credits

One key strategy is to maximize deductions and credits to reduce taxable income. Utilizing deductions such as mortgage interest, charitable contributions, and educational expenses can lower tax liabilities. Moreover, taking advantage of tax credits like the Earned Income Tax Credit and Child Tax Credit can further reduce taxes owed.This can be particularly beneficial in the 2026 tax year.

Capitalizing on Retirement Accounts

Contributing to retirement accounts like 401(k)s and IRAs can provide immediate tax savings by lowering taxable income. In 2026, individuals should aim to maximize contributions to these accounts to benefit from potential tax advantages.Planning for retirement is not only a wise financial choice but also a tax-efficient strategy.

Image: Tax Planning in 2026

Tips for Maximizing Tax Efficiency

As you plan for the 2026 tax season, it’s essential to strategize ways to maximize tax efficiency. By implementing smart tax practices, you can optimize your financial situation and potentially save money on taxes.

Utilize Tax-Advantaged Accounts

One effective way to enhance tax efficiency is by contributing to tax-advantaged accounts such as 401(k)s and Individual Retirement Accounts (IRAs). These accounts offer tax benefits such as tax-deferred growth or tax-free withdrawals, helping you save on taxes in the long run.

Take Advantage of Tax Deductions and Credits

Maximize your tax savings by leveraging deductions and credits available to you. Deductions like mortgage interest or charitable contributions can reduce your taxable income, while credits like the Child Tax Credit or the Education Credits directly lower your tax bill.

- Research and claim all eligible tax deductions

- Check if you qualify for any tax credits to reduce your tax liability

Stay Informed About Tax Law Changes

Keeping up to date with the latest tax laws and regulations is crucial for maximizing tax efficiency. Changes in tax laws can impact your tax situation, so staying informed can help you adapt your tax strategies accordingly.

Frequently Asked Questions

- What are tax rate schedules?

- Tax rate schedules are tables provided by the IRS that outline the tax rates based on income levels for a specific tax year.

- How do tax rate schedules work?

- Tax rate schedules work by applying different tax rates to different income brackets. As income increases, the corresponding tax rate may also increase.

- How can I find the 2026 tax rate schedules?

- The 2026 tax rate schedules will be made available by the IRS closer to the tax year 2026. You can find them on the IRS website or through tax preparation software.

- Do tax rate schedules change every year?

- Yes, tax rate schedules can change from year to year based on updates to tax laws and regulations. It is important to use the correct tax rate schedules for the specific tax year.

Final Thoughts: Navigating the 2026 Tax Rate Schedules

In conclusion, understanding the 2026 tax rate schedules is crucial for effective financial planning and compliance. These schedules outline the tax brackets and rates that determine how much individuals and businesses owe in taxes. By familiarizing yourself with these schedules, you can optimize your tax strategies, minimize liabilities, and make informed financial decisions.

Remember to stay updated on any changes to the tax rate schedules to adapt your financial plans accordingly. Consulting with a tax professional or using reliable tax software can also help simplify the process. Ultimately, being proactive and knowledgeable about the 2026 tax rate schedules can empower you to take control of your finances and achieve your financial goals.