Introduction to 2026 Tax Refund Schedule

As we step into the year 2026, it’s essential to understand the tax refund schedule for this year to better plan and manage our finances. The 2026 tax refund schedule outlines the dates when taxpayers can expect to receive their refunds from the government after filing their tax returns.

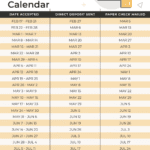

Key Dates for 2026 Tax Refund Schedule

Understanding the key dates for the 2026 tax refund schedule is crucial for individuals and businesses alike. The IRS typically provides estimated timelines for processing tax returns and issuing refunds.

- Filing Deadline: Taxpayers need to ensure they file their tax returns by the deadline to avoid any penalties or interest charges.

- Refund Processing Time: The IRS usually processes refunds within a specific timeframe after receiving a completed tax return.

- Direct Deposit vs. Mailed Check: Taxpayers can choose to receive their refunds via direct deposit or a traditional mailed check, each with its own processing time.

Tracking Your Refund Status

It’s important for taxpayers to be able to track the status of their refund once they’ve filed their taxes. The IRS provides online tools and resources that allow individuals to check the progress of their refund.

By entering specific information, such as their Social Security number and the exact refund amount, taxpayers can get real-time updates on when they can expect to receive their refund.

Importance of Understanding Tax Refund Dates

Ensuring you understand the 2026 tax refund schedule is crucial for effective financial planning. By knowing the specific dates when your tax refund is expected, you can better manage your budget, plan for any outstanding debts, and allocate funds towards savings or investments, increasing your financial stability and peace of mind.

Plan Ahead for Financial Obligations

Knowing the estimated dates of your tax refunds enables you to plan ahead for any upcoming financial obligations you may have. Whether it’s paying off loans, investing in further education, or making significant purchases, having a clear timeline through the 2026 tax refund schedule allows for informed decision-making.

Additionally, being aware of when your tax refund is expected can prevent unnecessary financial stress as you can align your expenses accordingly and avoid any last-minute financial strain.

Utilize Refund Wisely

Understanding tax refund dates also helps in utilizing the refunded amount wisely. Whether you choose to save, invest, or spend your refund, having a clear timeline through the 2026 tax refund schedule can assist in making informed choices.

By properly planning how to use your tax refund, you can achieve financial goals such as building an emergency fund, investing in retirement savings, or even funding a vacation, thus maximizing the benefits of your refund.

Factors Affecting 2026 Tax Refunds

As we look into the factors influencing the 2026 tax refund schedule, several key elements come into play that can impact the amount and timing of tax refunds individuals can expect to receive.

1. Changes in Tax Laws

One of the significant factors affecting tax refunds in 2026 is the changes in tax laws and regulations. With each tax year, new legislation or reforms can alter the tax rates, deductions, and credits available to taxpayers.

It is crucial for taxpayers to stay informed about these changes to accurately file their tax returns and maximize their potential refunds. 2026 tax refund schedule can be impacted by these alterations.

2. Filing Status and Income Level

The filing status and income level of an individual also play a significant role in determining the tax refund amount. Different filing statuses such as single, married filing jointly, or head of household can affect the tax liabilities and refunds.

Additionally, individuals with higher income levels may have different tax obligations compared to those with lower incomes, which can impact the refund amount they receive.

3. Deductions and Credits

Utilizing tax deductions and credits can have a direct impact on the tax refund amount. Deductions like mortgage interest, student loan interest, or charitable contributions can reduce taxable income, leading to a higher potential refund.

Various tax credits, such as the Earned Income Tax Credit or Child Tax Credit, can also increase refunds for eligible taxpayers. Understanding and claiming these deductions and credits accurately can positively affect the 2026 tax refund schedule.

Key Dates to Remember for Tax Refunds in 2026

As we kick off the new tax year, it’s essential to stay updated on the key dates for tax refunds in 2026 to manage your finances efficiently. Stay informed to avoid any delays or missed opportunities.

Submission Deadline

Deadline for filing tax returns for the year 2025 and claiming your tax refund is April 15, 2026. Make sure to submit your returns before this date to receive your refund on time.

Processing Time

Once you have submitted your tax return, the processing time for tax refunds varies. It typically takes around 3 weeks for electronic filings and 6 weeks for paper filings. Keep this timeline in mind to track your refund.

Direct Deposit vs. Check

Opting for direct deposit can expedite your refund process significantly. The funds are usually deposited in your account within a few days of processing. If you choose to receive a check by mail, expect additional mailing time.

Checking Your Refund Status

Stay updated by checking your refund status regularly. Visit the IRS website or use their mobile app to track your refund progress. Have your social security number, filing status, and exact refund amount handy.

Tips for Maximizing Your Tax Refund in 2026

Maximizing your tax refund is crucial to make the most of your financial resources. Here are some tips to help you get the most out of your tax refund in 2026:

Start Early and Stay Organized

Get a head start on your taxes by organizing all your financial documents early in the year. This will ensure that you don’t miss out on any deductions or credits that could increase your refund.

Creating a checklist or using tax software can help you stay organized and make the tax filing process smoother.

Maximize Deductions and Credits

Take advantage of all available deductions and credits to lower your taxable income and increase your tax refund. This includes deductions for charitable contributions, education expenses, and more.

Ensure you are aware of any tax law changes for 2026 that could affect your eligibility for certain deductions or credits.

Consider Retirement Contributions

Contributing to retirement accounts like a 401(k) or IRA can not only help you save for the future but also reduce your taxable income for the current year, potentially increasing your tax refund.

Check the contribution limits for 2026 and aim to maximize your contributions to take full advantage of the tax benefits.

Frequently Asked Questions

- When can I expect to receive my tax refund in 2026?

- Tax refund schedules can vary each year depending on a variety of factors. The IRS typically aims to issue refunds within 21 days of receiving a tax return, but it can take longer if there are errors, discrepancies, or if additional review is needed.

- Are there any changes to the tax refund schedule in 2026?

- The IRS may update the tax refund schedule each year based on factors like workload, legislation changes, or operational circumstances. It’s important to stay informed by checking the IRS official website or consulting with a tax professional for the most current information.

- How can I track the status of my tax refund in 2026?

- You can track the status of your tax refund for the 2026 tax year through the IRS’s ‘Where’s My Refund?’ tool on their website. You will need to provide your Social Security number, filing status, and exact refund amount to access the information.

- What factors can impact the timing of my tax refund in 2026?

- Several factors can influence the timing of your tax refund in 2026, such as filing errors, incomplete information, filing by mail instead of electronically, claiming certain credits, or being selected for additional review by the IRS. It’s essential to double-check your tax return for accuracy to avoid delays.

- If I file my taxes early in 2026, will I receive my refund sooner?

- Filing your taxes early in 2026 may potentially result in receiving your refund sooner, as the IRS processes tax returns on a first-come, first-served basis. However, the timing of your refund also depends on the factors affecting the processing speed at the IRS during that tax season.

Wrapping Up: 2026 Tax Refund Schedule

As we reach the end of our exploration into the 2026 tax refund schedule, it’s clear that proper planning and awareness are essential for a smooth tax season. Understanding the key dates and processes involved in receiving your tax refund can significantly impact your financial well-being. By staying informed and taking advantage of tools like online tracking systems, you can better anticipate and manage your refund. Remember, filing early can expedite the process and help you get your money sooner. We hope this information has empowered you to navigate the tax refund schedule with confidence and maximize your refunds efficiently.