Are you eagerly anticipating your tax refund, especially with the changes to the child tax credit by the IRS in 2026? Understanding the tax refund schedule and how it pertains to the child tax credit can help you plan your finances better. The IRS’s adjustments to the child tax credit can significantly impact your refund amount and when you can expect to receive it. Stay informed about the 2026 tax refund schedule and how the child tax credit changes may influence it by following this guide. Let’s delve into the important details and timelines that every taxpayer should be aware of.

Understanding the 2026 Tax Refund Schedule

As we navigate through the year 2026, many taxpayers eagerly anticipate the release of the tax refund schedule from the IRS. Understanding the 2026 tax refund schedule, especially in relation to the child tax credit, is crucial for proper financial planning.

Importance of the 2026 Tax Refund Schedule

The 2026 tax refund schedule plays a vital role in helping taxpayers anticipate when they can expect to receive their refunds. This timeline is particularly essential for families relying on the child tax credit to bolster their finances.

Child Tax Credit Updates for 2026

In 2026, the child tax credit remains a significant aspect of tax refunds for eligible families. It’s important to stay informed about any updates or changes in the child tax credit guidelines to maximize your tax refund.

By keeping abreast of the IRS tax refund schedule and understanding the implications for the child tax credit in 2026, taxpayers can effectively plan for their financial future and make informed decisions regarding their tax refunds.

Eligibility for Child Tax Credit in 2026

As we move into the year 2026, understanding the eligibility criteria for the Child Tax Credit is crucial for taxpayers. To qualify for the Child Tax Credit in 2026, the child must be under the age of 17 at the end of the tax year and must be claimed as a dependent on the taxpayer’s return. Additionally, the child must have a valid Social Security Number and be a U.S. citizen, resident alien, or a qualifying resident of the U.S.

Income Limits

For 2026, taxpayers must also meet income requirements to be eligible for the full Child Tax Credit. The credit begins to phase out for individuals with an adjusted gross income (AGI) above $200,000 and for married couples filing jointly with an AGI above $400,000.

Additional Requirements

In addition to the age and dependency criteria, there are other requirements for the Child Tax Credit. The child must have lived with the taxpayer for more than half of the tax year, and the child must not have provided more than half of their own support.

Key Information about the IRS for Taxpayers in 2026

As a taxpayer in 2026, understanding the IRS processes and updates is crucial for a smooth tax season. The IRS has released the 2026 tax refund schedule, including important details for claiming the Child Tax Credit.

2026 Tax Refund Schedule

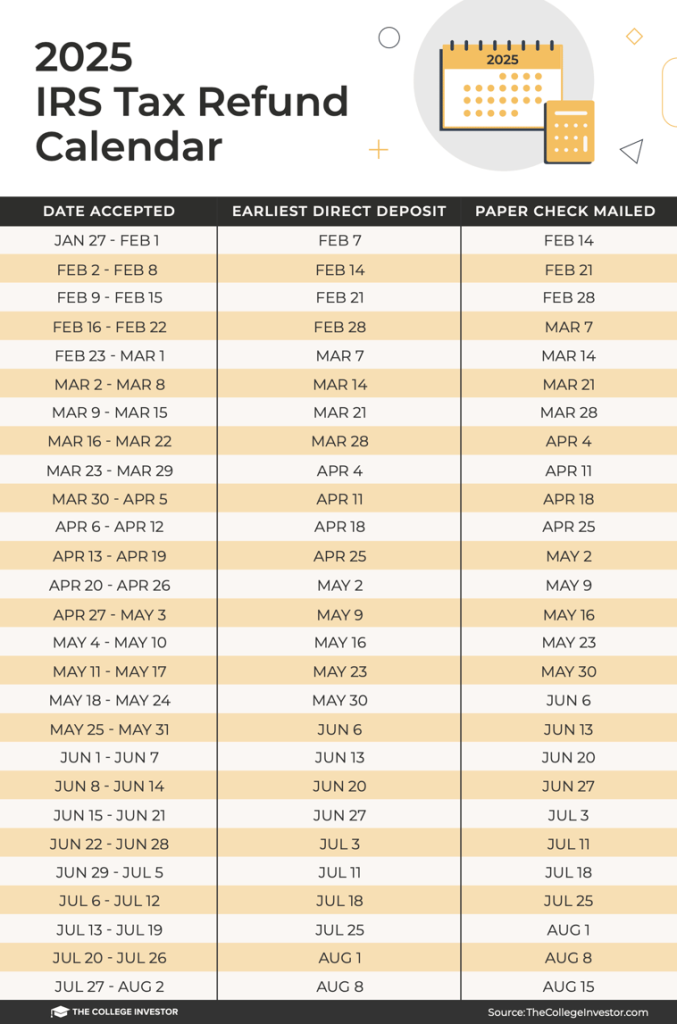

The IRS has provided a detailed tax refund schedule for 2026, outlining the dates when taxpayers can expect to receive their refunds. It is essential to refer to this schedule to know when to anticipate your tax refund.

Child Tax Credit Updates

In 2026, the Child Tax Credit remains a valuable tax benefit for eligible families. The IRS has made certain adjustments to the credit, so it is important to stay updated on the latest information to ensure you maximize your tax savings.

Frequently Asked Questions

- When can I expect my tax refund for 2026?

- The schedule for tax refund distribution can vary each year, but normally tax refunds are issued within 21 days if you file electronically. The exact date of your refund will depend on various factors such as how you filed and if there were any errors on your return.

- Will the child tax credit impact my tax refund for the year 2026?

- The child tax credit can impact your tax refund as it provides a credit up to a certain amount per qualifying child. This credit can reduce the amount of taxes you owe or increase your tax refund, depending on your situation.

- How does the IRS determine the schedule for tax refunds?

- The IRS typically releases a schedule each year outlining when taxpayers can expect to receive their refunds. This schedule is based on various factors such as the volume of returns and any changes to tax laws or processing systems.

- Are there any changes to the tax refund schedule for the child tax credit in 2026?

- Any changes to the tax refund schedule, particularly for the child tax credit, will be communicated by the IRS. It’s important to stay updated with official IRS announcements and publications for accurate information regarding tax refunds.

Unlocking Future Benefits: Final Thoughts on 2026 Tax Refund Schedule Child Tax Credit IRS

As we explore the 2026 tax refund schedule and the nuances of claiming the child tax credit with the IRS, it becomes evident that careful planning and awareness can lead to significant financial advantages. Understanding the schedule, eligibility criteria, and IRS guidelines can empower taxpayers to make informed decisions and maximize their refunds.

By staying informed about the latest updates from the IRS and leveraging available resources, taxpayers can navigate the tax season with confidence. Remember, early planning, accurate documentation, and timely filing are key to ensuring a smooth tax refund process and optimizing benefits like the child tax credit.

As we look ahead to 2026 and beyond, let’s harness this knowledge to secure our financial well-being and unlock the full potential of tax refunds and credits. Here’s to a future filled with financial security and prosperity!