Are you eagerly anticipating your tax refund for the year 2026? Understanding the 2026 tax refund schedule provided by the IRS is crucial for proper financial planning. The IRS determines the schedule for issuing tax refunds each year, and knowing the timeline can help you better manage your expectations and finances. By staying informed about the 2026 tax refund schedule, you can estimate when to expect your refund and make decisions accordingly. In this blog, we will dive into the details of the 2026 tax refund schedule set by the IRS, providing you with valuable insights to guide you through the refund process efficiently.

Introduction to 2026 Tax Refund Schedule IRS

As we enter 2026, taxpayers are eagerly awaiting information on the tax refund schedule provided by the IRS. Understanding the timeline of when to expect your tax refund can help with financial planning and budgeting for the year ahead. The 2026 tax refund schedule from the IRS outlines the dates when taxpayers can anticipate receiving their refunds based on various factors like filing method and refund method.

Factors Affecting Refund Timeline

Several factors can impact the timeline for receiving your tax refund in 2026. It is crucial to consider aspects such as how you filed your taxes, whether electronically or by mail, and if you chose direct deposit or a paper check for your refund.

IRS Processing Times

The IRS processes tax returns in a specific order, which can influence when you receive your refund. Understanding the typical processing times can give you an idea of when to expect your refund in 2026. It’s essential to file your taxes accurately and promptly to avoid any delays in the processing of your refund.

Understanding the IRS Refund Process

When it comes to the 2026 tax refund schedule from the IRS, understanding the refund process is crucial for taxpayers. The IRS typically issues refunds within 21 days of processing a tax return, but this timeline can vary based on the method of filing and any discrepancies in the return.

Processing Time

The processing time for refunds can be impacted by various factors, such as the accuracy of the return, any errors, or missing information. E-filing tends to result in faster refunds compared to paper filing.

It is essential to double-check all information provided to avoid delays in receiving your refund 2026 tax refund schedule irs.

Checking Refund Status

To track your refund, the IRS offers an online tool called “Where’s My Refund?” This tool provides real-time updates on the status of your refund, including the expected deposit date.

- Input your Social Security number

- Choose your filing status

- Enter the exact refund amount

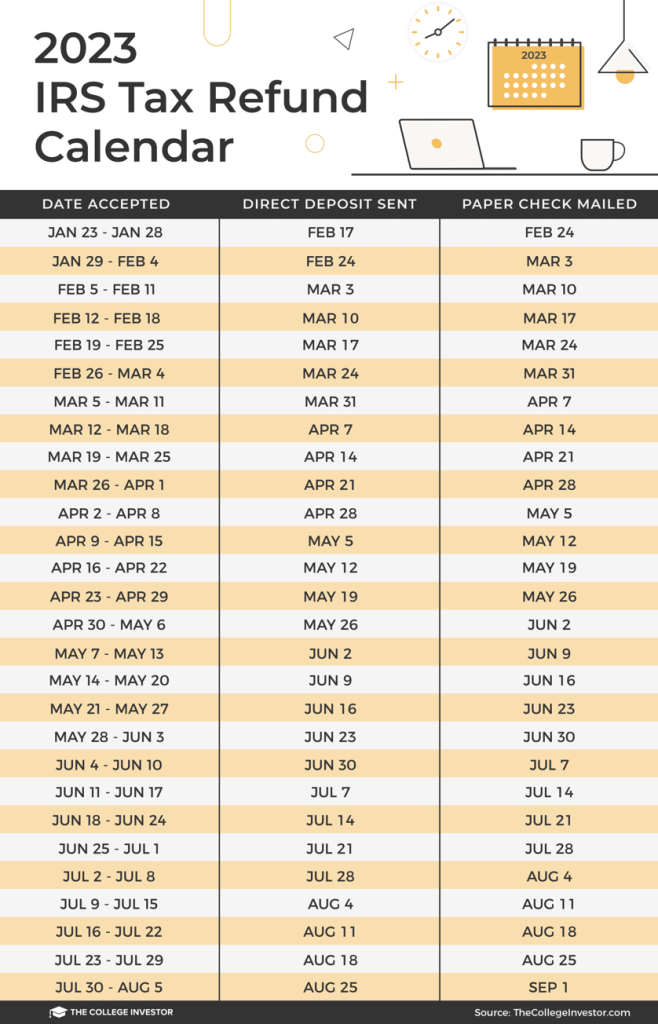

Important Dates for the 2026 Tax Refund Schedule

As taxpayers eagerly anticipate their tax refunds for the 2026 tax year, being aware of the important dates on the tax refund schedule is crucial for effective planning and financial management. The IRS has outlined specific dates that individuals should mark on their calendars to track the progress of their refund.

IRS Tax Filing Start Date

The IRS typically begins accepting tax returns for the tax year 2026 in late January or early February. Taxpayers should aim to file their returns as soon as possible to expedite the refund process. Submission of accurate information is key to avoiding delays.

Expected Refund Arrival Dates

For those who file their tax returns electronically and choose to receive their refunds via direct deposit, refunds are usually issued within 21 days from the acceptance of the return. Choosing direct deposit is the fastest way to receive your refund.

- Direct Deposit Refunds: Approximately within 21 days

- Refunds by Mail: Allow for additional time for postal delivery

How to Track Your Refund Status

Tracking your tax refund status with the IRS is crucial to know when to expect your money. For the 2026 tax refund schedule, the IRS offers multiple ways to check the status of your refund. The most convenient method is through the IRS website’s “Where’s My Refund?” tool.

Using the “Where’s My Refund?” Tool

To track your refund, go to the IRS website and click on the “Refunds” tab. Enter your Social Security number, filing status, and the exact refund amount as shown on your return. This tool provides real-time updates on your refund’s status.

Calling the IRS

If you prefer a personal touch, you can call the IRS refund hotline at 1-800-829-1954. Be prepared with your Social Security number, filing status, and the refund amount to get the latest information on your refund.

Common Questions About Tax Refunds

As taxpayers eagerly await their 2026 tax refunds from the IRS, several questions often arise. Here are some common queries that individuals have regarding tax refunds for the current year:

When Can I Expect to Receive My Tax Refund?

Typically, the IRS issues tax refunds within 21 days of receiving a tax return. However, the exact timing can vary based on factors like how the return was filed (electronically or by mail) and any discrepancies or errors that may need to be corrected.

How Can I Check the Status of My Refund?

To track the status of your tax refund, you can use the IRS’s online tool called “Where’s My Refund?”. You will need to provide your Social Security number, filing status, and the exact refund amount to access this information.

What Should I Do if My Refund is Delayed?

If your tax refund is delayed beyond the usual timeframe, it could be due to various reasons, such as errors on your return, missing documents, or identity theft concerns. In such cases, contacting the IRS directly can often help resolve the issue.

Tips for Maximizing Your Tax Refund

Maximizing your tax refund is essential in getting the most out of your hard-earned money. Here are some tips to help you make the most of your tax refund in 2026.

1. Stay Updated on the 2026 Tax Refund Schedule from IRS

Knowing the key dates of the 2026 tax refund schedule from the IRS is crucial for planning your finances. Be aware of when to expect your refund to avoid any delays or surprises. Stay informed to maximize your refund efficiency.

2. Utilize Tax Deductions and Credits

Make sure to take advantage of all available tax deductions and credits for the year 2026. This includes deductions for education expenses, charitable donations, and more. Maximizing your deductions can significantly increase your refund.

3. Contribute to Retirement Accounts

Consider contributing to retirement accounts such as 401(k) or IRA to reduce your taxable income. By investing in your retirement, you not only secure your future but also potentially increase your tax refund for the year 2026.

Frequently Asked Questions

- When can I expect my 2026 tax refund from the IRS?

- The IRS generally issues tax refunds within 21 days of receiving a tax return. However, the exact timing may vary based on factors such as the complexity of your return and how you filed.

- How can I check the status of my 2026 tax refund?

- You can check the status of your tax refund using the ‘Where’s My Refund?’ tool on the IRS website. You will need to provide your Social Security number, filing status, and the exact refund amount.

- Are there any delays expected in the 2026 tax refund schedule?

- Delays in tax refunds can occur due to various reasons such as incomplete or incorrect information on the tax return, identity theft verification, or backlog at the IRS. It’s advisable to check the IRS website for any updates on potential delays.

- Can I speed up the process of receiving my tax refund?

- You can potentially expedite your tax refund by filing your tax return electronically, choosing direct deposit for your refund, and ensuring that all information on your return is accurate. However, the processing time ultimately depends on the IRS.

- What should I do if I haven’t received my tax refund within the expected time frame?

- If you haven’t received your tax refund within the expected time frame, you can contact the IRS directly or use the ‘Where’s My Refund?’ tool for more information. There may be additional steps required to resolve any issues causing a delay.

Wrapping Up: Key Points to Remember

As we eagerly await the 2026 tax refund schedule from the IRS, it’s essential to stay informed and prepared. Understanding the timeline for tax refunds can help you plan your finances effectively. Remember to file your taxes accurately and promptly to expedite the refund process. Keep track of key dates and deadlines to avoid any delays in receiving your refund.

Additionally, staying updated on any changes in IRS procedures or policies can streamline the refund process for you. Utilize online tools and resources provided by the IRS to track your refund status conveniently. By staying proactive and informed, you can ensure a smooth and efficient tax refund experience in 2026 and beyond.