Are you eagerly awaiting your tax refund in 2026? Understanding the 2026 tax refund schedule is essential to ensure you receive your money back on time. Navigating the intricacies of tax regulations can be daunting, but with the right information, you can streamline the process and anticipate when to expect your refund. In this comprehensive guide, we will break down the 2026 tax refund schedule, providing you with valuable insights and tips to help you manage your finances efficiently. Stay tuned to learn about key dates, filing deadlines, and proactive measures you can take to maximize your tax refund for the upcoming year.

Understanding the 2026 Tax Refund Schedule

As taxpayers eagerly anticipate their refunds, understanding the 2026 tax refund schedule is crucial. The schedule outlines the expected dates when individuals can receive their refunds based on when they filed their tax returns.

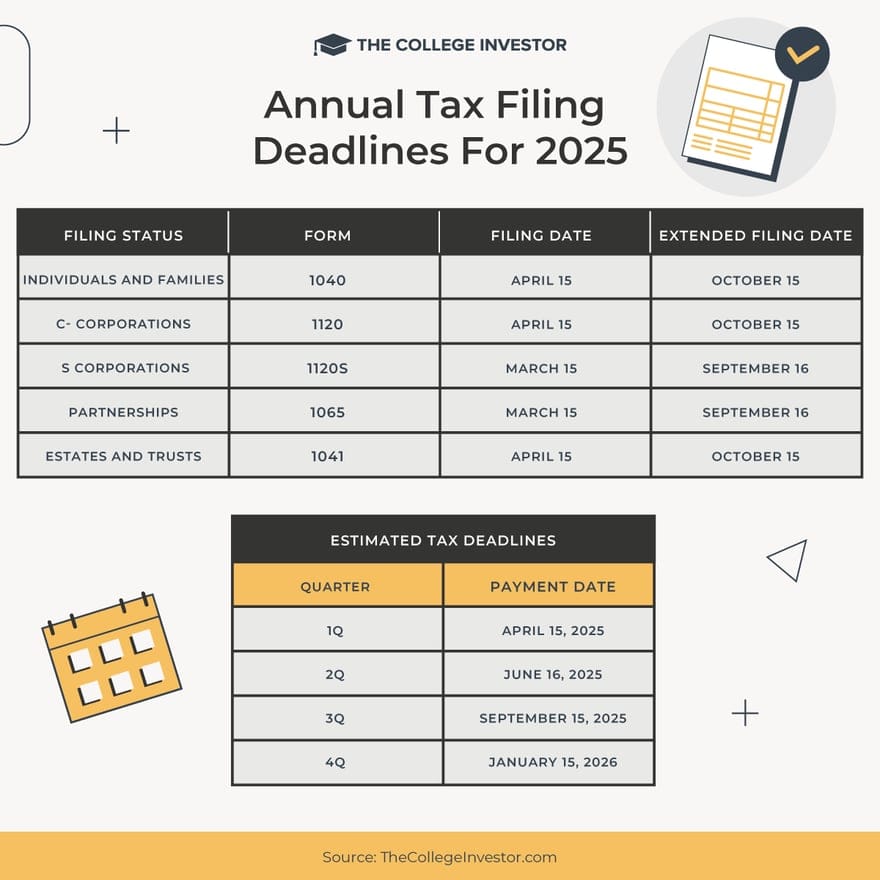

Key Dates to Remember

For the 2026 tax year, the IRS typically begins accepting tax returns in late January. The refund processing time varies depending on how the return was filed and whether any issues arose during processing.

It’s important for taxpayers to be aware of key dates, such as the deadline for filing taxes and when refunds are expected to be issued, to ensure they receive their money back on time.

Factors Affecting Refund Timelines

Several factors can impact the timing of tax refunds. These include the method of filing (e-file or mail), errors on the return, and claiming certain credits. Taxpayers should double-check their returns for accuracy to avoid delays in receiving their refunds.

- Electronic Filing: Taxpayers who file their returns electronically typically receive their refunds faster than those who file paper returns.

- Claiming Credits: Certain tax credits, such as the Earned Income Tax Credit or the Additional Child Tax Credit, may delay refunds due to additional processing requirements.

Key Dates to Remember for Your Tax Refund

One of the most anticipated aspects of the tax season is receiving your tax refund. To ensure you get your 2026 tax refund on time, it’s crucial to be aware of the key dates in the tax refund schedule.

Submission Deadline

Make sure to submit your tax return by the deadline, typically around mid-April 2026. Filing your taxes on time can significantly impact when you receive your refund, so don’t delay!

Refund Processing Time

Once your tax return is submitted, the processing time for refunds can vary. In general, receiving your refund within three weeks of e-filing is common, but this can be longer if you file a paper return.

Direct Deposit Options

If you opt for direct deposit, you can receive your refund faster compared to a paper check. Make sure to provide accurate banking information to avoid any delays in receiving your 2026 tax refund.

Steps to Ensure a Timely Tax Refund in 2026

Receiving a tax refund promptly is crucial for many individuals. To ensure you get your money back on time in 2026, follow these essential steps:

File Your Taxes Early

Filing your taxes early is one of the best ways to expedite your refund process. By submitting your tax return as soon as possible, you increase the chances of receiving your refund promptly.

Double-Check Your Information

Ensure all your tax information is accurate and up to date before submitting your return. Any errors or discrepancies can cause delays in processing your refund.

Opt for Direct Deposit

Choosing to receive your refund through direct deposit is faster than waiting for a paper check. This electronic method is secure and expedites the refund delivery process.

Monitor Your Refund Status

After filing your taxes, regularly check the status of your refund using the IRS online tool. This enables you to track the progress and address any issues promptly.

Tips for Maximizing Your Tax Refund Amount

Maximizing your tax refund amount can help you make the most of your hard-earned money. Here are some tips to ensure you get the maximum refund possible in the 2026 tax season:

1. Keep Accurate Records

One of the key factors in maximizing your tax refund is to keep accurate records of all your income, expenses, and deductions throughout the year. This includes receipts, invoices, and any relevant financial documents. Organize your documents in a systematic manner for easy reference.

2. Take Advantage of Tax Credits and Deductions

Make sure you are aware of all the tax credits and deductions available to you. This includes credits for education expenses, home improvements, and retirement savings. Consult a tax professional to ensure you are claiming all eligible deductions.

- Claiming dependents

- Home office deductions

- Charitable contributions

3. File Your Taxes Early

Filing your taxes early can help you get your refund sooner. By submitting your return promptly, you can avoid delays and receive your refund within the 2026 tax refund schedule timeline. File online for quicker processing.

Common Mistakes to Avoid When Filing for a Tax Refund

When seeking a tax refund according to the 2026 tax refund schedule, it’s crucial to steer clear of common filing mistakes that could delay or jeopardize your refund. One common error to avoid is submitting incomplete information on your tax return. Make sure all required fields are filled accurately to prevent processing delays.

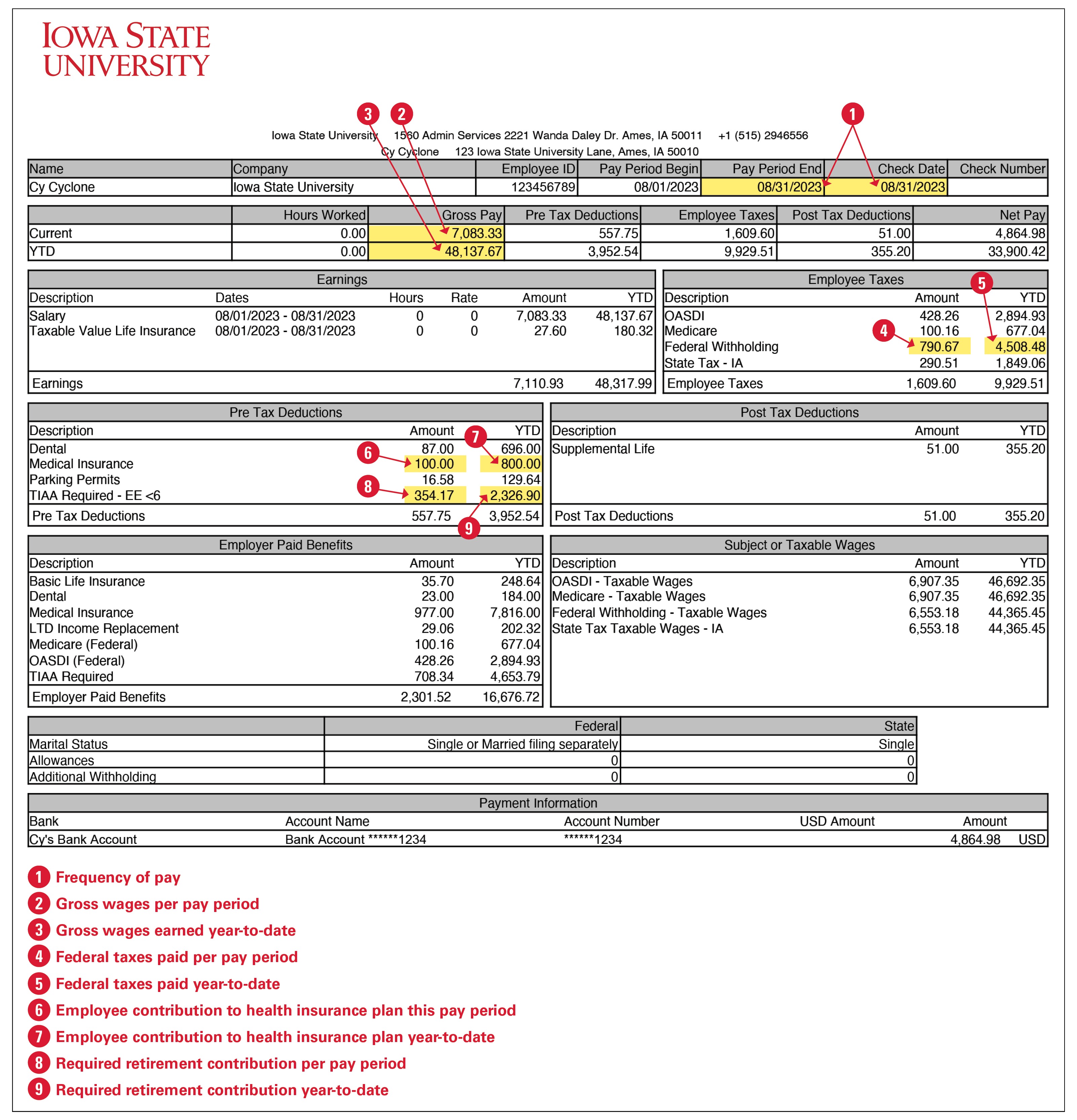

Missing Documentation

Ensure you have all necessary documentation, such as W-2 forms, receipts, and supporting documents, before filing your tax return. Failure to provide these documents could lead to errors in your filing, potentially resulting in a delayed refund.

Additionally, double-check that the information on your forms matches the details you provide in your return to avoid discrepancies that might trigger an audit.

Incorrect Details

Another prevalent mistake is providing incorrect personal information or financial details. Small errors in your Social Security number, bank account information, or income figures can lead to processing issues and delays in receiving your refund.

- Review your information carefully before submitting to ensure accuracy.

- Avoid using estimates where exact figures are required.

Frequently Asked Questions

- When can I expect to receive my tax refund in 2026?

- The tax refund schedule for 2026 typically varies based on when you file your taxes and how you choose to receive your refund. It’s advisable to file your taxes early to receive your refund sooner.

- What factors can impact the timing of my tax refund?

- Several factors can affect when you receive your tax refund in 2026. This includes how you file your taxes (electronically or by mail), any errors or missing information on your tax return, and if you claim certain tax credits or deductions that require additional processing time.

- How can I check the status of my tax refund for the year 2026?

- You can check the status of your tax refund for 2026 using the IRS’s ‘Where’s My Refund’ tool on their website. You will need your Social Security number, filing status, and the exact amount of your expected refund to access this information.

- Are there any ways to expedite the processing of my tax refund?

- While there is no guaranteed way to expedite the processing of your tax refund, filing your taxes electronically and opting for direct deposit can generally result in a faster refund compared to filing by mail and requesting a paper check.

- What should I do if I haven’t received my tax refund by the expected date?

- If you haven’t received your tax refund by the expected date, check the status using the IRS tools. If further action is needed, you may need to contact the IRS directly to inquire about the status of your refund.

Unlocking the 2026 Tax Refund Schedule

As we navigate through the intricacies of tax refunds in 2026, it’s crucial to stay informed and proactive to ensure a smooth refund process. By understanding the 2026 tax refund schedule and filing early, you can secure your refund on time and avoid unnecessary delays. Remember to utilize online tools, stay organized with your documentation, and consider e-filing for faster processing.

Whether you’re planning a major purchase or looking to boost your savings, timely tax refunds can be a valuable financial resource. Stay updated with any changes to the IRS timeline and deadlines, and don’t hesitate to seek professional assistance if needed. By following these guidelines, you can maximize your chances of receiving your refund promptly.

So, mark your calendars, set reminders, and stay proactive to make the most of your 2026 tax refund. Utilize the schedule to your advantage and enjoy the financial benefits that come with timely tax refunds. Here’s to a successful and rewarding tax season!