As we gear up towards the year 2026, understanding the upcoming 2026 tax schedule becomes crucial for individuals and businesses alike. The 2026 tax schedule encompasses the proposed changes in tax laws, rates, deductions, and credits that will impact taxpayers in the coming year. Being informed about these changes can help in better financial planning and compliance with the tax regulations.

Whether you are a salaried individual, a small business owner, or a corporation, staying abreast of the 2026 tax schedule is essential to optimize your tax position and avoid any surprises during tax season. In this blog, we will explore the key highlights of the 2026 tax schedule, potential implications for taxpayers, and strategies to navigate the upcoming changes successfully.

Overview of the 2026 Tax Schedule

As we delve into the intricate details of the 2026 tax schedule, it is crucial to stay informed about the latest updates and changes affecting taxpayers in the upcoming year. Understanding the tax schedule can help individuals and businesses navigate their financial obligations seamlessly.

Changes in Tax Rates

In the 2026 tax schedule, there may be adjustments to tax rates that can impact how much individuals and businesses need to pay. It is vital to stay updated on these changes to accurately calculate tax liabilities.

Deductions and Credits

Exploring the deductions and credits available in the 2026 tax schedule can provide opportunities for taxpayers to reduce their taxable income and potentially lower their overall tax burden. Being aware of these options is key to maximizing savings.

Significance and Importance of the 2026 Tax Schedule

The 2026 tax schedule plays a crucial role in determining the tax liabilities of individuals and businesses for the relevant tax year. Understanding the significance and importance of the 2026 tax schedule can help taxpayers plan their finances effectively and ensure compliance with tax laws.

Accuracy of Tax Reporting

One of the key benefits of the 2026 tax schedule is that it provides a structured framework for taxpayers to report their income, deductions, and credits accurately. By following the guidelines outlined in the tax schedule, taxpayers can minimize errors in their tax returns, reducing the risk of audits or penalties.

Timely Filing and Payment

Adhering to the 2026 tax schedule ensures that taxpayers meet important deadlines for filing their tax returns and making payments. Timely compliance with tax obligations helps avoid late filing penalties and interest charges, allowing individuals and businesses to stay current with their tax responsibilities.

Planning for Tax Liabilities

By reviewing the 2026 tax schedule in advance, taxpayers can estimate their tax liabilities for the year and make necessary adjustments to their financial plans. Understanding how the tax schedule impacts their tax situation enables individuals to take advantage of available deductions and credits to minimize their tax burden.

Key Changes and Updates in the 2026 Tax Schedule

As we delve into the 2026 tax schedule, it’s essential to highlight the key changes and updates that taxpayers need to be aware of for the upcoming year. Understanding these modifications can help individuals and businesses better navigate their tax obligations.

New Tax Brackets and Rates

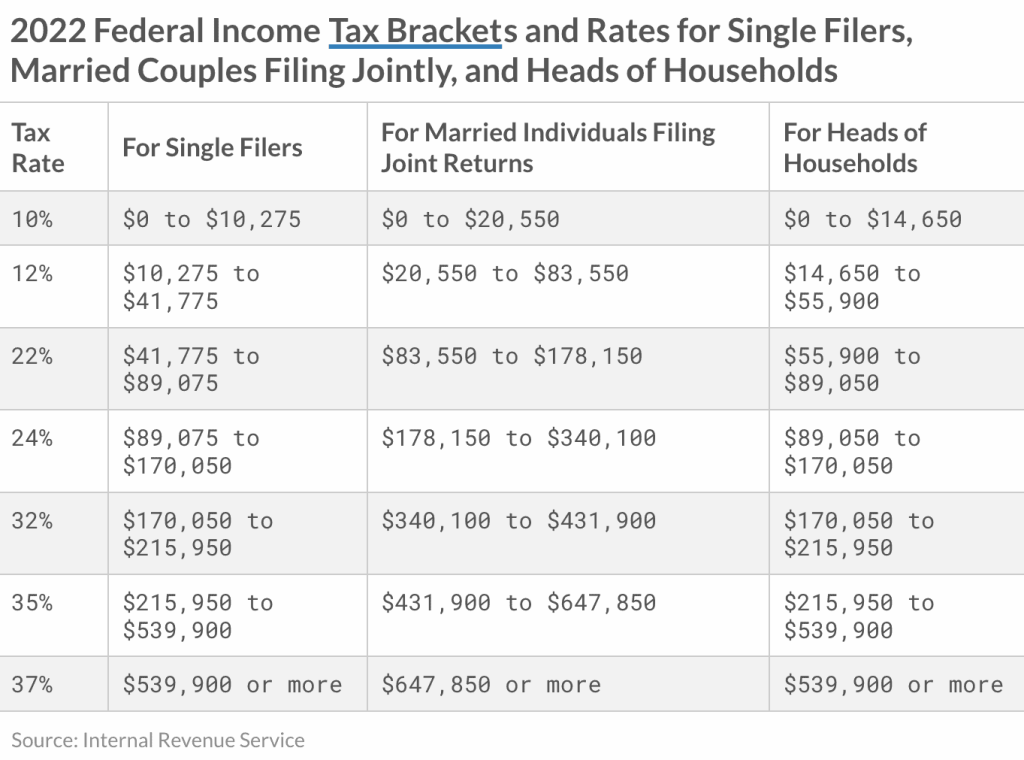

In 2026, the tax brackets and rates have been adjusted to account for inflation and economic conditions. Taxpayers should review these changes to determine how they will impact their tax liability.

The 2026 tax schedule introduces slight adjustments to the income thresholds for each tax bracket, potentially altering the amount of tax owed by individuals.

Enhanced Deductions and Credits

One significant update in the 2026 tax schedule is the introduction of enhanced deductions and credits aimed at providing additional financial relief to taxpayers.

Individuals may benefit from new deductions related to specific expenses, while businesses could qualify for increased tax credits for certain activities.

How to Utilize the 2026 Tax Schedule for Tax Planning

As we head towards the tax year 2026, understanding and utilizing the 2026 tax schedule for tax planning is crucial for individuals and businesses alike. The 2026 tax schedule outlines the tax rates, brackets, deductions, and credits that will be applicable for the year 2026. By familiarizing yourself with this schedule, you can make informed decisions to optimize your tax strategy and minimize your tax liability.

Review Tax Rates and Brackets

One key aspect of the 2026 tax schedule is the tax rates and brackets. Familiarize yourself with the different tax rates applicable to various income levels to understand how much tax you will owe based on your earnings. This knowledge can help you plan your finances effectively and potentially explore ways to reduce your taxable income.

Additionally, considering tax-efficient investments or retirement account contributions can help you stay within lower tax brackets and reduce your overall tax burden.

Maximize Deductions and Credits

Another important aspect of tax planning using the 2026 tax schedule is to maximize deductions and credits available to you. Take advantage of deductions such as mortgage interest, charitable contributions, and educational expenses to reduce your taxable income.

Moreover, explore available tax credits like the Earned Income Tax Credit or Child Tax Credit to lower your tax bill further. Understanding which deductions and credits you qualify for can significantly impact your overall tax liability.

Comparing the 2026 Tax Schedule with Previous Years

As we delve into the 2026 tax schedule, it’s essential to compare it with previous years to understand the changes and implications. Looking back at the tax schedules of the past years provides valuable insights into how the tax system has evolved over time.

Changes in Tax Brackets

One significant aspect to analyze is the adjustments in tax brackets. The 2026 tax schedule may witness modifications in income thresholds and tax rates compared to prior years. Understanding these changes is crucial for taxpayers to plan their finances effectively.

Moreover, comparing the tax brackets between 2026 and previous years can help individuals assess if they fall into a different tax bracket this year.

Update on Deductions and Credits

Another key area to explore is the updates on deductions and tax credits available in the 2026 tax schedule. Taxpayers should pay attention to potential changes in deductible expenses and credits that could impact their tax liabilities.

- Reviewing deductions such as mortgage interest or charitable contributions for the current year is essential to maximize tax savings. Utilizing available credits effectively can also reduce tax obligations.

Frequently Asked Questions

- What is the 2026 tax schedule?

- The 2026 tax schedule refers to the tax rates and income brackets that will be in effect for the tax year 2026.

- When will the 2026 tax schedule be available?

- The IRS typically releases the tax schedule for the upcoming year towards the end of the current year. So, the 2026 tax schedule is expected to be available in late 2025.

- How does the 2026 tax schedule impact taxpayers?

- The 2026 tax schedule will determine the amount of federal income tax that individuals and businesses will owe based on their taxable income for the year 2026.

- Are there any changes expected in the 2026 tax schedule compared to previous years?

- Tax schedules can be adjusted annually by Congress, so there is a possibility of changes in the tax rates and income brackets for 2026 compared to previous years.

- Where can I find more information about the 2026 tax schedule?

- You can stay updated on the IRS website or consult with tax professionals for detailed information about the 2026 tax schedule and how it may affect your tax situation.

Final Thoughts

As we dive into the details of the 2026 tax schedule, it becomes evident that proper planning and understanding of the tax implications are crucial for financial success. The changes and updates in the tax laws can significantly impact individuals and businesses alike. Whether it’s adjusting income brackets, deductions, or credits, staying informed and proactive is key.

By familiarizing ourselves with the 2026 tax schedule, we empower ourselves to make informed financial decisions, optimize tax strategies, and maximize savings. Remember, seeking professional advice and utilizing available resources can simplify the complexities of taxation and ensure compliance with the latest regulations. Stay informed, plan ahead, and make the most of the 2026 tax schedule for a financially secure future.