Understanding the income tax schedule for 2026 is crucial for individuals, businesses, and tax professionals alike as it provides a detailed outline of tax rates and brackets for the upcoming tax year. The income tax schedule 2026 determines how much tax individuals and businesses will owe based on their income levels. By familiarizing yourself with the income tax schedule for 2026, you can effectively plan your finances, strategize tax-saving opportunities, and ensure compliance with the tax laws. In this blog, we will delve into the key aspects of the income tax schedule 2026, including changes, implications, and important considerations to help you navigate the upcoming tax year successfully.

Introduction to Income Tax Schedule 2026

Income tax schedule plays a crucial role in organizing tax payments for individuals and businesses. In the year 2026, the income tax schedule outlines the specific tax rates and brackets that taxpayers fall into based on their earnings.

Key Changes in Income Tax Schedule 2026

For the tax year 2026, there have been several updates to the income tax schedule, including adjustments to tax rates, brackets, and deductions. Taxpayers are advised to review the new schedule to ensure compliance with the updated regulations.

- New Tax Brackets implemented

- Additional Deductions introduced

Important Deadlines for Income Tax Filing in 2026

It is essential for taxpayers to be aware of the deadlines for filing income tax returns in 2026. Failing to meet these deadlines can result in penalties and fines imposed by tax authorities.

- Individual Tax Returns due by April 15, 2026

- Business Tax Returns due by March 15, 2026

Changes and Updates in Income Tax Laws for 2026

As we step into 2026, there are significant changes in the income tax laws that every taxpayer must be aware of. The income tax schedule 2026 brings about modifications in tax rates, deductions, and credits that can impact your financial planning.

New Tax Rates

For the year 2026, the government has introduced new tax brackets with revised rates. Taxpayers should carefully review these changes to ensure accurate compliance with the law.

Ensure you consult a tax professional to determine how these new rates may affect your tax liability in 2026.

Enhanced Deductions and Credits

In line with the changing tax landscape, certain deductions and credits have been enhanced to provide additional relief to taxpayers. Make sure to take advantage of these benefits in the tax year 2026.

- Increased standard deduction amount

- Expanded eligibility for certain tax credits

Understanding the Income Tax Schedule for Different Income Levels

When it comes to navigating the intricacies of the income tax schedule for the year 2026, it is crucial to understand how different income levels are taxed. The tax schedule outlines the percentage of income that individuals or entities are required to pay as taxes depending on their earnings.

Low-Income Bracket

Individuals falling under the low-income bracket for 2026 typically pay a lower tax rate, making it easier for them to manage their finances. However, it is essential to stay informed about any changes that may affect this group.

Medium to High-Income Bracket

For those in the medium to high-income bracket, the tax schedule may indicate a higher percentage of their income being taxed. This emphasizes the importance of tax planning and seeking professional advice to optimize tax liabilities.

- Thorough tax planning

- Utilizing deductions and credits effectively

- Consulting with tax experts

Tips for Efficiently Filing Taxes According to the 2026 Schedule

As per the updated income tax schedule 2026, it’s crucial to stay organized when filing taxes for the year. One essential tip is to start early to avoid the last-minute rush. Ensure you have all the necessary documents, including W-2s, 1099s, and receipts, to accurately report your income and deductions.

Utilize Tax Software or Professional Assistance

If you find taxes overwhelming, consider using tax software or seeking help from a tax professional. These tools can streamline the process, minimize errors, and ensure you take advantage of all eligible tax credits and deductions.

Review Changes in Tax Laws

With the income tax schedule 2026 in effect, it’s essential to stay informed about any changes in tax laws that may impact your filing. Be aware of new credits, deductions, and regulations that could affect your tax liability.

Maximize Retirement Contributions

Contributing to retirement accounts like IRAs or 401(k)s can lower your taxable income. Before the tax deadline, ensure you’ve maximized your contributions to take full advantage of potential tax savings.

Common Mistakes to Avoid When Dealing with Income Tax Schedule 2026

When handling your income tax related to Schedule 2026, it’s crucial to avoid certain common mistakes that taxpayers often make. One of the main blunders is miscalculating your deductions or credits, which can lead to inaccuracies in your tax return and potentially trigger an audit.

Overlooking Documentation

One mistake is overlooking the importance of proper documentation. It is essential to keep track of all receipts and necessary paperwork to substantiate your claims and ensure compliance with the regulations of Income Tax Schedule 2026. Proper record-keeping is the key to a smooth tax filing process.

Missing Filing Deadlines

Failing to meet the filing deadlines is another common mistake taxpayers make. Missing the deadline can result in penalties and unnecessary stress. To avoid this, set reminders and prioritize timely filing to prevent any issues with the IRS. Always submit your tax return on time to avoid penalties.

Inaccurate Reporting

Providing inaccurate information on your tax return can have serious consequences. It’s crucial to double-check all the details you provide to ensure accuracy. Mistakes in reporting income, deductions, or credits can lead to complications and potential legal issues. Take your time to review your tax return carefully.

Benefits and Drawbacks of the New Income Tax Schedule

As we delve into the details of the Income Tax Schedule for the year 2026, it is crucial to understand both the benefits and drawbacks associated with it.

Benefits of the New Income Tax Schedule

One of the primary benefits of the updated Income Tax Schedule for 2026 is the revised tax brackets that might result in lower tax liabilities for many taxpayers.

Additionally, the increased standard deduction limits can provide relief for individuals and families by reducing their taxable income.

Drawbacks of the New Income Tax Schedule

On the other hand, one potential drawback could be the elimination or reduction of certain deductions and credits, which might adversely impact specific taxpayers.

Moreover, any changes in the tax rates or income thresholds could result in higher taxes for some individuals, offsetting the benefits for others.

Frequently Asked Questions

- What is the income tax schedule for 2026?

- The income tax schedule for 2026 refers to the tax rates and income brackets that individuals and businesses will be subject to for the tax year 2026.

- Where can I find the income tax schedule for 2026?

- The income tax schedule for 2026 can typically be found on the official website of the tax authority in your country or region, as well as in official tax publications.

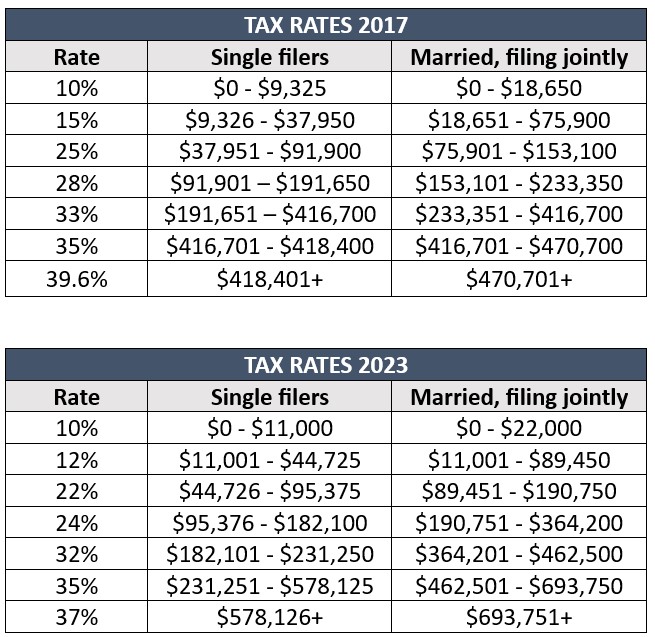

- How is the income tax schedule for 2026 different from previous years?

- The income tax schedule for 2026 may differ from previous years in terms of tax rates, income brackets, deductions, and credits, which are usually adjusted to account for inflation and changes in tax laws.

- Are there any proposed changes to the income tax schedule for 2026?

- Proposed changes to the income tax schedule for 2026 may vary depending on government policies, economic conditions, and legislative actions that could impact tax rates and brackets for the upcoming year.

- How can I calculate my income tax liability using the 2026 schedule?

- You can calculate your income tax liability for 2026 by determining your taxable income, applying the corresponding tax rates based on your income bracket, and factoring in any deductions or credits that may apply according to the 2026 tax schedule.

Key Takeaways from the Income Tax Schedule 2026

As we conclude our exploration of the income tax schedule for 2026, it is evident that taxpayers need to stay informed and proactive to navigate the evolving tax landscape effectively. Understanding the updated tax brackets and deductions can help individuals and businesses make informed financial decisions. It is essential to leverage available resources, such as tax calculators and professional guidance, to ensure accurate tax filings and maximize savings.

In summary, the Income Tax Schedule 2026 serves as a roadmap for taxpayers to plan their finances strategically and comply with legal obligations. By staying informed, organized, and proactive, individuals and businesses can manage their tax liabilities efficiently and make the most of available deductions.

Stay ahead of the curve, keep abreast of tax law changes, and consult with tax professionals to optimize your tax planning efforts in the upcoming tax year.