Are you eagerly awaiting your tax refund for the year 2026? Understanding the IRS 2026 refund schedule is crucial to managing your finances effectively. The IRS refund schedule provides taxpayers with essential information on when they can expect to receive their refunds based on various factors such as filing method and refund type. By staying informed about the IRS 2026 refund schedule, you can plan your expenses accordingly and avoid any unexpected delays in receiving your tax refund. In this blog, we will explore the intricacies of the IRS 2026 refund schedule and provide insights to help you navigate the tax refund process with ease.

Understanding IRS Refunds

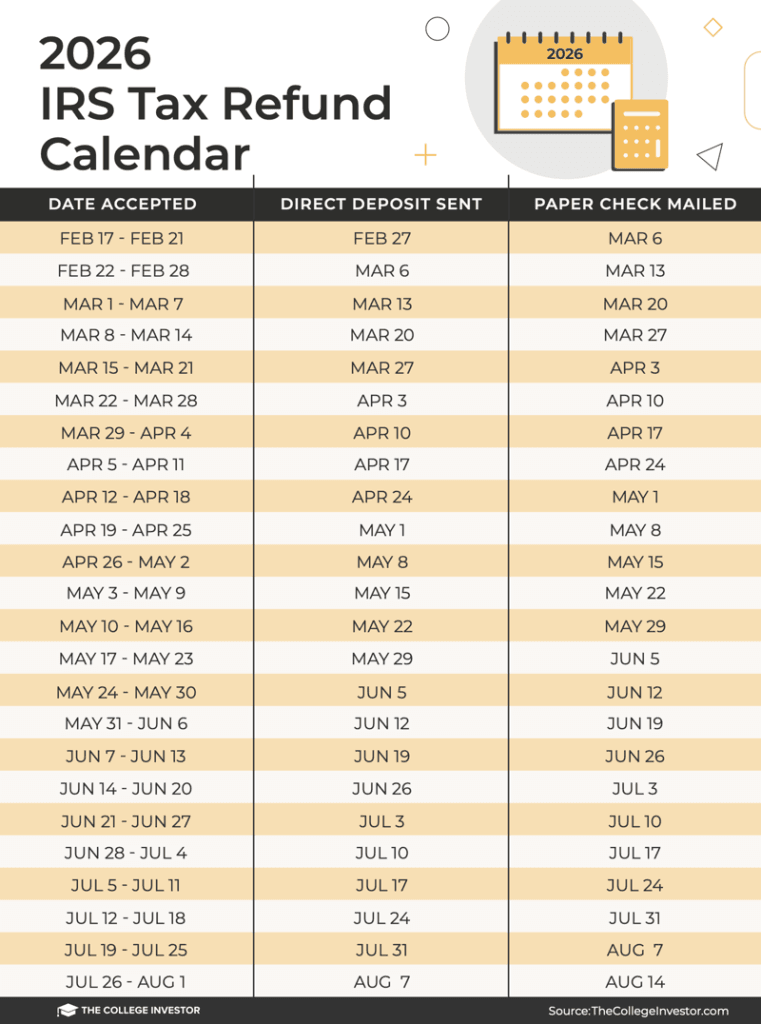

When it comes to IRS refunds for the year 2026, it’s essential to know the schedule for when you can expect to receive your money back from the government. The IRS 2026 refund schedule provides taxpayers with a timeline for when they can anticipate their refunds based on when they filed their tax returns.

IRS Refund Schedule Overview

The IRS typically issues refunds within 21 days for electronic returns and six weeks for paper returns. It’s important to note that the processing time may vary based on factors such as errors in the return, the method of filing, and the complexity of the tax return.

Checking Your Refund Status

To track the status of your IRS refund for 2026, you can use the “Where’s My Refund?” tool on the IRS website. This tool allows you to see the progress of your refund, including when it was approved and the anticipated deposit date. Make sure to have your social security number, filing status, and exact refund amount on hand to use the tool.

Common Reasons for Refund Delays

If your refund is delayed, it could be due to various reasons such as errors on your tax return, incomplete information, or suspected identity theft. In such cases, the IRS may require additional verification before processing your refund.

IRS 2026 Refund Schedule Overview

As taxpayers eagerly anticipate their refunds from the IRS, understanding the 2026 refund schedule is crucial for proper planning and financial management. The IRS 2026 refund schedule outlines the timeline for when taxpayers can expect to receive their refunds based on various factors.

IRS Refund Processing Times

The IRS typically issues refunds within 21 days of receiving a tax return, provided it was filed electronically. However, several factors can affect this timeline, such as errors on the return, forms that need to be reviewed manually, or suspected identity theft.

It is important for taxpayers to accurately file their returns and provide the necessary documentation to avoid delays in receiving their refunds.

IRS Refund Options

When it comes to receiving refunds, taxpayers have the option to choose direct deposit into their bank account, receiving a paper check through the mail, or allocating their refund to purchase U.S. Savings Bonds.

Opting for direct deposit is the quickest way to receive refunds, with most taxpayers seeing the funds in their accounts within a few days of the refund being issued.

Checking Your Refund Status

To track the status of their refunds, taxpayers can use the IRS “Where’s My Refund?” tool available on the IRS website. By entering specific information like their Social Security number, filing status, and exact refund amount, taxpayers can get real-time updates on the status of their refunds.

It is advisable to check the refund status periodically to stay informed about any potential issues or delays in the processing of the refund.

Common Reasons for Refund Delays

Some common reasons for delays in receiving refunds include inaccuracies in tax returns, missing or incomplete information, or the need for additional verification of identity. Taxpayers should review their returns carefully to ensure all information is accurate to avoid potential delays in receiving their refunds.

Factors Affecting Refund Timelines

When it comes to receiving your IRS 2026 refund schedule, several factors can influence the timeline of when you can expect to get your refund. Understanding these factors can help you manage your expectations and plan your finances accordingly.

1. Filing Method

The method you use to file your tax return can impact how quickly you receive your refund. E-filing typically results in faster processing times compared to mailing a paper return.

2. Accuracy of Information

Ensuring that all information on your tax return is accurate can help prevent delays in processing. Mistakes or missing information may require additional review and can slow down the refund process.

3. Tax Season Demand

During peak tax season, the IRS may experience a higher volume of returns, leading to longer processing times. Planning ahead and filing early can help you avoid potential delays in receiving your refund.

4. Refund Method

Choosing direct deposit for your refund is typically faster than receiving a paper check in the mail. Providing accurate banking information is crucial for a seamless and speedy refund process.

How to Track Your IRS Refund

Tracking your IRS refund for the year 2026 is crucial to know the status of your tax refund. The process is simple and can be done online through the IRS website or via the IRS2Go mobile app. Here’s how you can effectively track your refund:

Using the IRS Website

1. Visit the official IRS website and navigate to the “Where’s My Refund?” tool.

2. Enter your Social Security number, filing status, and the exact refund amount as shown on your tax return.

3. Click on “Check My Refund Status” to get real-time updates on the status of your refund.

Utilizing the IRS2Go App

1. Download the IRS2Go mobile app from the App Store or Google Play Store.

2. Launch the app and select the “Check Refund Status” option.

3. Enter the required personal information to access your refund status on-the-go.

Tips for Expedited Refunds

Getting your IRS 2026 refund schedule and expediting your refund can be crucial for many taxpayers. Here are some helpful tips to speed up your refund process:

File Electronically

One of the fastest ways to receive your refund is by filing your taxes electronically. This method is quicker and more accurate than filing by mail.

Additionally, make sure to double-check your information to avoid errors that could delay the refund process significantly.

Choose Direct Deposit

Opting for direct deposit rather than a paper check can expedite your refund. Direct deposit allows the IRS to deposit your refund directly into your bank account, often within a few days.

Monitor Your Refund Status

Stay updated on the status of your refund by using the IRS “Where’s My Refund” tool. This tool provides real-time information on the progress of your refund, including the expected date of deposit.

Remember to have your social security number, filing status, and the exact refund amount ready to check your status without any hitches.

Provide Accurate Information

Ensure all your personal and financial information is accurate and up to date when filing your taxes. Inaccurate information can lead to delays in processing your refund.

Double-check your social security number, bank account details, and any other relevant information to prevent any unnecessary issues.

Frequently Asked Questions

- What is the IRS 2026 refund schedule?

- The IRS 2026 refund schedule refers to the timeline in which taxpayers can expect to receive their tax refunds from the Internal Revenue Service in the year 2026.

- When can I expect my tax refund according to the IRS 2026 refund schedule?

- The specific timing of when you can expect your tax refund in 2026 will depend on various factors, including how you filed your taxes and whether there are any issues with your return.

- How can I check the status of my tax refund for 2026?

- You can check the status of your tax refund for 2026 using the ‘Where’s My Refund’ tool on the IRS website or by calling the IRS refund hotline.

- Are there any changes to the IRS refund schedule for 2026 compared to previous years?

- It is important to stay updated with any changes to the IRS refund schedule for 2026, as timing and processes may vary from previous years due to legislative or administrative changes.

- What should I do if I haven’t received my tax refund according to the IRS 2026 refund schedule?

- If you haven’t received your tax refund as expected based on the IRS 2026 refund schedule, you should first check the status of your refund online or contact the IRS for further assistance.

Unlocking the IRS 2026 Refund Schedule: Closing Thoughts

As we conclude our exploration of the IRS 2026 refund schedule, it is evident that understanding the timeline and knowing what to expect can alleviate some of the stress associated with tax season. By staying informed about IRS procedures and timelines, taxpayers can better plan for their financial futures.

Remember, the IRS 2026 refund schedule may vary based on individual circumstances, so it’s crucial to stay updated through official IRS channels. Utilize online resources, such as the IRS website, and consider consulting a tax professional for personalized advice.

By arming yourself with knowledge and being proactive, you can navigate the tax refund process with confidence and ease. Here’s to a successful and stress-free tax season!