Are you eagerly awaiting your IRS refunds for the year 2026? Understanding the IRS refunds 2026 schedule is crucial for planning your finances. It is essential to stay informed about the key dates and processes involved in receiving your tax refunds from the IRS in 2026. Navigating the IRS refund system can be complex, but with the right information at hand, you can streamline the process and anticipate when to expect your refund. In this blog, we will delve into the IRS refunds 2026 schedule, important deadlines, possible delays, and tips to maximize and expedite your tax refund this year.

Introduction to IRS Refunds

IRS refunds are a crucial part of the annual tax filing process for individuals and businesses. Understanding the IRS refund schedule for the year 2026 is essential for taxpayers to plan their finances accordingly.

What are IRS Refunds?

IRS refunds are the excess amount of money that a taxpayer has paid to the Internal Revenue Service (IRS) during the tax year. If the taxpayer has overpaid their taxes through employer withholding or estimated tax payments, they are entitled to receive a refund.

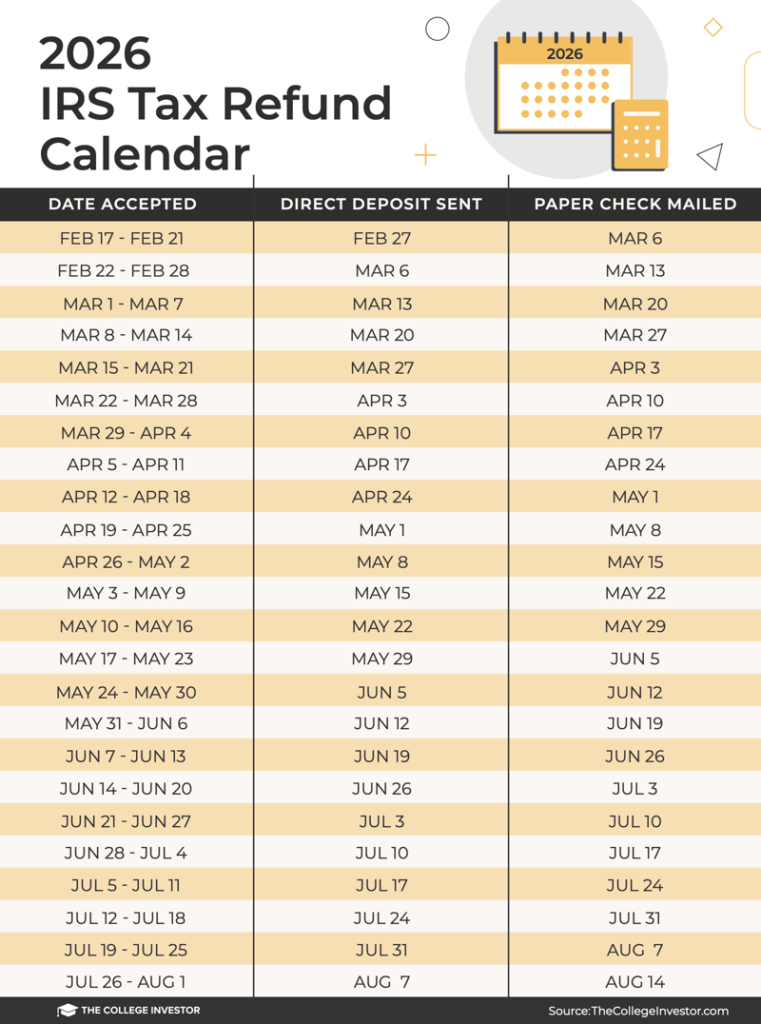

IRS Refunds 2026 Schedule

The IRS refund schedule for 2026 outlines the dates when taxpayers can expect to receive their refunds. It is important to note that the refund processing times may vary based on various factors such as the method of filing, accuracy of the return, and any potential errors that need to be corrected.

It is recommended to file your taxes electronically and choose direct deposit as the refund method for faster processing and receipt of your refund. The IRS typically issues refunds within 21 days for electronically filed returns. Paper returns may take longer to process.

Understanding the IRS Refund Process

When it comes to IRS refunds in 2026, understanding the process can help you navigate the system more effectively. Here’s a breakdown of how the IRS refund process works for the year 2026:

1. Filing Your Taxes

Before expecting a refund, you need to file your taxes accurately and on time. Make sure to include all relevant information to avoid delays in the refund process.

If your taxes are in order, the IRS will start processing your refund. This usually takes around 21 days from the date your tax return is received.

2. Check Refund Status

To check the status of your IRS refund for 2026, you can use the IRS’s online tool “Where’s My Refund?”. This tool provides real-time updates on the status of your refund.

Additionally, you can also track your refund through the IRS2Go mobile app, making it convenient to stay updated on the progress of your refund.

3. Receive Your Refund

Once your refund is approved, the IRS will issue the refund either through direct deposit or by mailing a check to your address on file. Direct deposit is the fastest way to receive your refund.

It’s essential to double-check your banking information to ensure a smooth direct deposit process, minimizing any potential delays in receiving your refund.

Key Dates for IRS Refunds in 2026

When it comes to receiving your IRS refunds in 2026, it’s essential to be aware of the key dates to expect your money. The schedule for IRS refunds in 2026 is crucial for individuals and families to plan their finances efficiently.

Refund Schedule Breakdown

The IRS typically issues refunds within 21 days of receiving a tax return, but the timeframe may vary based on multiple factors.

For early filers who submit their returns electronically, refunds may be processed faster compared to paper filers.

Expected Timeframes

Most taxpayers can expect to receive their refunds by late February or early March if there are no issues with their tax return.

If additional verification is required or if there are errors in the tax documents, the refund process may be delayed.

Checking Your IRS Refund Status

When eagerly anticipating your IRS refund for the year 2026, staying updated on its status is crucial. The IRS refunds schedule for 2026 has specific timelines for processing refunds, and knowing where yours stands can provide peace of mind.

Using the IRS Online Tool

To check your IRS refund status for 2026, you can utilize the IRS online tool specifically designed for this purpose. Enter essential details such as your Social Security Number, filing status, and the exact refund amount to get real-time information.

Calling the IRS Helpline

If you prefer a more personal touch, you can contact the IRS helpline and speak to a representative regarding your refund status. Be prepared to provide the same details mentioned earlier to receive accurate details.

Tips for Expedited IRS Refunds

If you are eagerly waiting for your IRS refunds in 2026, follow these tips to expedite the process and get your money sooner.

File Online

Electronic filing is faster than traditional paper filing. Utilize online platforms or the IRS e-file system which can speed up the processing of your return.

Provide Accurate Information

Ensure all your details like social security number, income, and deductions are correct to avoid delays in the processing of your refund.

Opt for Direct Deposit

Choosing direct deposit can expedite your refund as the money is directly transferred to your bank account, bypassing any mail delays.

Track Your Refund

Stay updated on the status of your refund by using the IRS’s “Where’s My Refund?” tool online. It provides real-time information on the progress of your refund.

Avoid Amending Your Return

Avoid making unnecessary changes to your return after filing. Amendments can slow down the processing of your refund.

Frequently Asked Questions

- When will the IRS refunds for 2026 become available?

- The IRS refund schedule for 2026 has not been released yet. Typically, the IRS releases a refund schedule each year outlining when taxpayers can expect to receive their refunds.

- How can I check the status of my IRS refund for 2026?

- Taxpayers can check the status of their IRS refund for 2026 by using the ‘Where’s My Refund’ tool on the IRS website or by calling the IRS refund hotline.

- What factors can affect the timing of IRS refunds in 2026?

- Several factors can affect the timing of IRS refunds in 2026, including the method of filing (e-filed returns are processed faster), errors on the tax return, claims for refundable tax credits, and IRS processing times.

- Are there any changes to the IRS refund process for 2026?

- It’s essential to stay updated with any changes to the IRS refund process for 2026, as tax laws and procedures can change each year. It is recommended to regularly check the IRS website for any updates.

Concluding Thoughts on IRS Refunds 2026 Schedule

As we navigate through the intricacies of the IRS refunds 2026 schedule, it becomes evident that staying informed and proactive is key to maximizing your tax refund experience. Understanding the timeline, being aware of any potential delays, and ensuring accurate filing are crucial steps in securing your refund promptly.

Remember to utilize online resources provided by the IRS, seek professional guidance if needed, and stay updated on any changes or updates to the refund schedule. By following these practices, you can streamline the process and receive your well-deserved refund without unnecessary delays.

Stay proactive, stay informed, and make the most of the IRS refunds 2026 schedule to ensure a smooth and efficient refund process.