Are you eagerly waiting for your IRS tax refund in 2026? Utilizing an IRS tax refund schedule and calculator can help you estimate the arrival time of your refund. The IRS tax refund schedule 2026 acts as a guideline for when you can expect to receive your refund based on when you filed your taxes. By using a tax refund calculator, you can input specific details such as your income, deductions, and credits to get a more accurate prediction of your refund amount.

Understanding the IRS tax refund schedule 2026 and using a calculator can provide valuable insights into your financial planning. Stay informed and make the most of your tax refund with the help of these tools.

Understanding IRS Tax Refund Schedule

When it comes to receiving your tax refund, it’s essential to understand the IRS Tax Refund Schedule for 2026. Knowing the schedule can help you estimate when you can expect to receive your refund, allowing you to plan your finances accordingly.

IRS Refund Processing Time

The IRS typically processes refunds within 21 days for electronic returns and within six weeks for paper returns. It’s important to note that the IRS may experience delays, especially during peak filing times.

Checking Your Refund Status

To track the status of your refund, you can use the IRS’s online tool, “Where’s My Refund?” All you need is your Social Security number, filing status, and the exact refund amount to get real-time updates on your refund status.

Overview of Tax Refund Calculations

Calculating your tax refund can be a crucial step in managing your finances. For the IRS tax refund schedule 2026 calculator, it’s essential to understand how refunds are determined.

The Basics of Tax Refund Calculation

When you file your taxes, your refund is based on various factors like your income, deductions, credits, and tax payments throughout the year. The IRS uses this information to determine if you’ve paid more in taxes than you owe.

Calculations are done using a formula that considers taxable income, tax rates, and any eligible tax credits which can increase your refund amount.

IRS Tax Refund Schedule 2026

The IRS usually issues refunds within 21 days of receiving a tax return, but some factors like errors, incomplete forms, or fraud suspicions may delay the process.

Using an IRS tax refund schedule 2026 calculator can help estimate when you might receive your refund based on the date you filed and the method of payment.

Changes and Updates for 2026

As we step into 2026, the IRS tax refund schedule has undergone significant modifications to streamline the refund process for taxpayers using the IRS tax refund schedule 2026 calculator. Updated guidelines now ensure that taxpayers can expect quicker refunds and improved accuracy in calculations.

New Refund Processing System

The IRS has implemented a new state-of-the-art refund processing system for 2026. This system is designed to expedite the processing of refunds, leading to faster disbursal of funds to eligible taxpayers. The streamlined system aims to reduce delays and inaccuracies, providing a more efficient experience for taxpayers.

Enhanced Online Tools

Along with the new processing system, the IRS has enhanced its online tools, including the IRS tax refund schedule 2026 calculator. Taxpayers can now access user-friendly interfaces that offer real-time updates on their refund status. These tools provide detailed information on refund amounts, expected payment dates, and any necessary actions required from the taxpayer.

Using a Tax Refund Calculator

Calculating your tax refund can be a daunting task, but with the help of an IRS Tax Refund Schedule 2026 Calculator, the process becomes much simpler and more accurate. These online tools are designed to provide you with an estimate of how much money you can expect to receive in your tax refund based on your income, deductions, credits, and tax withholdings. By inputting the relevant information into the calculator, you can quickly determine the amount you may receive back from the IRS.

Benefits of Using a Tax Refund Calculator

One of the key benefits of using a tax refund calculator is that it helps you plan your finances more effectively. By knowing how much you are likely to receive in your tax refund, you can make informed decisions about how to allocate those funds. Additionally, the calculator can help you identify any potential errors in your tax return before you submit it, reducing the risk of delays or audits.

Moreover, using an IRS Tax Refund Schedule 2026 Calculator can save you time and effort by providing you with an instant estimate, eliminating the need for manual calculations or guesswork.

How to Use a Tax Refund Calculator

Using a tax refund calculator is straightforward. Simply enter your income, deductions, credits, and tax withholdings into the designated fields on the calculator. Make sure to input accurate information to get a more precise estimate. Once you have entered all the necessary details, the calculator will generate a projected tax refund amount based on the data provided. Remember, this is just an estimate, and your actual refund amount may vary.

Tips for Maximizing Your Tax Refund

Maximizing your tax refund is crucial to ensure you are getting back as much money as possible that you are entitled to. Here are some essential tips to help you make the most of your tax refund in 2026:

1. File Early

Submitting your tax return early can help expedite the refund process. Use the IRS tax refund schedule 2026 calculator to estimate when you can expect your refund.

2. Take Advantage of Deductions

Make sure to claim all eligible deductions to reduce your taxable income. Common deductions include mortgage interest, student loan interest, and charitable contributions.

3. Contribute to Retirement Accounts

Contributing to retirement accounts such as an IRA or 401(k) can lower your taxable income and potentially increase your tax refund.

4. Consider Tax Credits

Explore tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit to see if you qualify. These credits can directly reduce your tax liability or even result in a refund if they exceed the amount you owe.

5. Review Your Filing Status

Ensure you are using the correct filing status, as it can impact your tax refund amount. Consider consulting a tax professional to determine the most advantageous filing status for your situation.

Common Questions About IRS Tax Refunds

When it comes to IRS tax refunds in 2026, there are several common questions that taxpayers often have. Understanding the tax refund schedule and calculator can help individuals better plan their finances and anticipate when they might receive their refund.

1. How to Check IRS Tax Refund Status

IRS provides various methods to check your tax refund status for 2026. One way is through the Where’s My Refund tool on the IRS website. You’ll need to enter your Social Security number, filing status, and exact refund amount to get real-time updates.

2. Factors Affecting Refund Processing Time

Several factors can impact the processing time of your tax refund. These include the method of filing (e-file or mail), accuracy of information provided, and potential errors or audits. Ensure all details are correct to avoid delays.

- Tip: File electronically for quicker processing!

Frequently Asked Questions

- What is an IRS tax refund schedule?

- An IRS tax refund schedule is a timeline provided by the Internal Revenue Service that indicates when taxpayers can expect to receive their tax refunds.

- How does the IRS tax refund schedule for 2026 work?

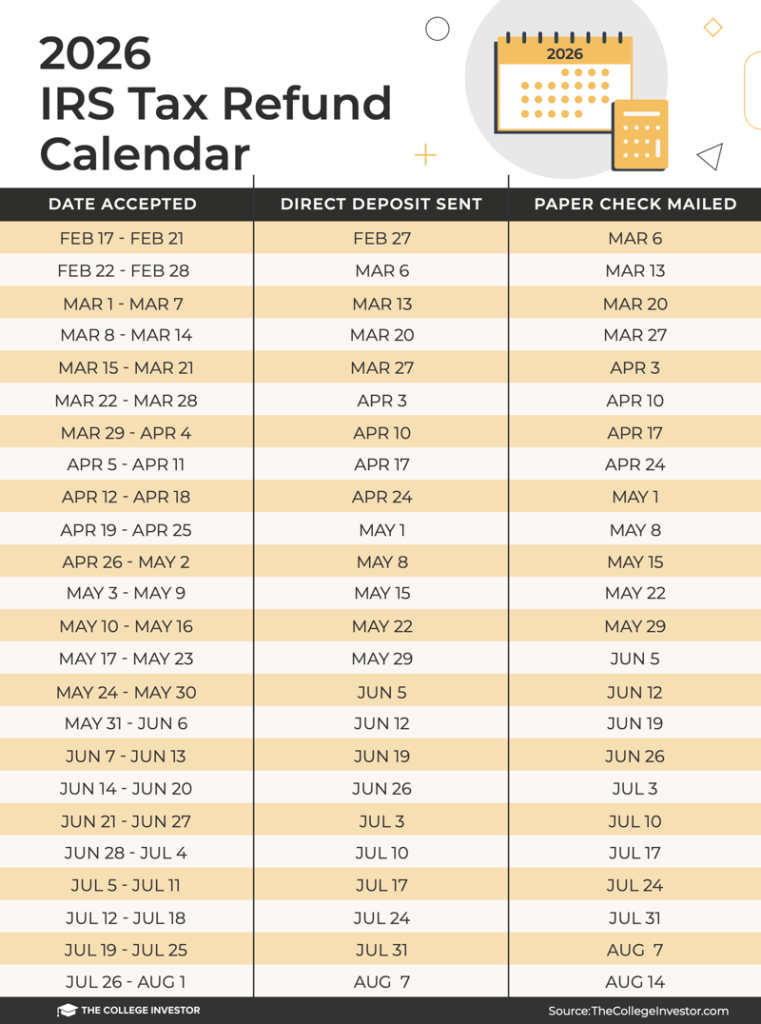

- The IRS tax refund schedule for 2026 outlines the dates when taxpayers can anticipate receiving their tax refunds based on when they filed their tax returns and the method by which they chose to receive their refunds.

- Is there a specific calculator for estimating IRS tax refunds for 2026?

- Yes, there are various online tools and calculators available that can help estimate your IRS tax refund for the year 2026 based on the information you provide.

- What factors can affect the IRS tax refund schedule for 2026?

- Factors such as errors in your tax return, the method of filing (e-filed returns typically receive refunds faster than paper returns), and any additional reviews required by the IRS can impact the timing of your tax refund.

- How can I check the status of my IRS tax refund for 2026?

- You can check the status of your IRS tax refund for 2026 by using the ‘Where’s My Refund’ tool on the IRS website or by calling the IRS refund hotline.

Final Thoughts on IRS Tax Refund Schedule 2026 Calculator

As we conclude our exploration of the IRS tax refund schedule 2026 calculator, it is evident that staying informed about important deadlines and using tools like the calculator can greatly benefit taxpayers. By understanding the schedule and estimating refund amounts, individuals can better plan their finances and avoid unnecessary stress. The convenience and accuracy offered by these calculators make them invaluable resources for anyone expecting a tax refund.

Remember, timely tax filing and utilizing tools like the IRS tax refund schedule 2026 calculator can streamline the refund process and ease financial planning. Stay updated with any changes in tax laws and make the most of available resources to manage your taxes effectively.