Are you eagerly awaiting your Michigan tax refund for the year 2026? Understanding the Michigan tax refund schedule for 2026 is crucial to ensure you receive your funds in a timely manner. Whether you filed electronically or by mail, knowing when to expect your refund can help you plan your finances effectively.

In this blog, we will break down the Michigan tax refund schedule for 2026, highlighting key dates and important information to help you track the progress of your refund. Stay tuned as we explore the process, potential delays, and tips to expedite your refund. Let’s navigate the Michigan tax refund schedule together for a smooth and hassle-free experience!

Introduction to Michigan Tax Refund Schedule 2026

Planning ahead for tax refunds is crucial, and understanding the Michigan Tax Refund Schedule for 2026 is essential for residents. The schedule dictates the timeline within which taxpayers can expect to receive their refunds. Stay informed to manage your finances effectively.

Key Features of Michigan Tax Refund Schedule 2026

Michigan tax refund processing times may vary based on individual circumstances. However, the general timeline provided by the state offers insights into when you can anticipate receiving your refund.

For the year 2026, taxpayers can expect refunds to be issued within a few weeks to a month after their returns are processed, provided there are no complications or errors.

Steps to Check Your Michigan Tax Refund Status

To track the status of your Michigan tax refund for 2026, utilize the Michigan Department of Treasury’s online “Where’s My Refund” tool. Simply enter your Social Security number, filing status, and expected refund amount to get real-time updates on your refund’s progress.

- Visit the Michigan Department of Treasury website

- Locate the “Where’s My Refund” tool

- Enter required details to access your refund status information

Understanding Tax Refunds in Michigan

Michigan taxpayers eagerly anticipate their tax refunds, especially in 2026. The Michigan tax refund schedule for 2026 outlines the timeline for taxpayers to receive refunds based on when they filed their returns.

Importance of Timely Filing

Submitting your tax return early can expedite the processing of your refund. The sooner you file, the quicker you can expect to receive your refund.

Michigan tax refund schedule 2026 emphasizes the benefits of filing on time.

Methods of Receiving Refunds

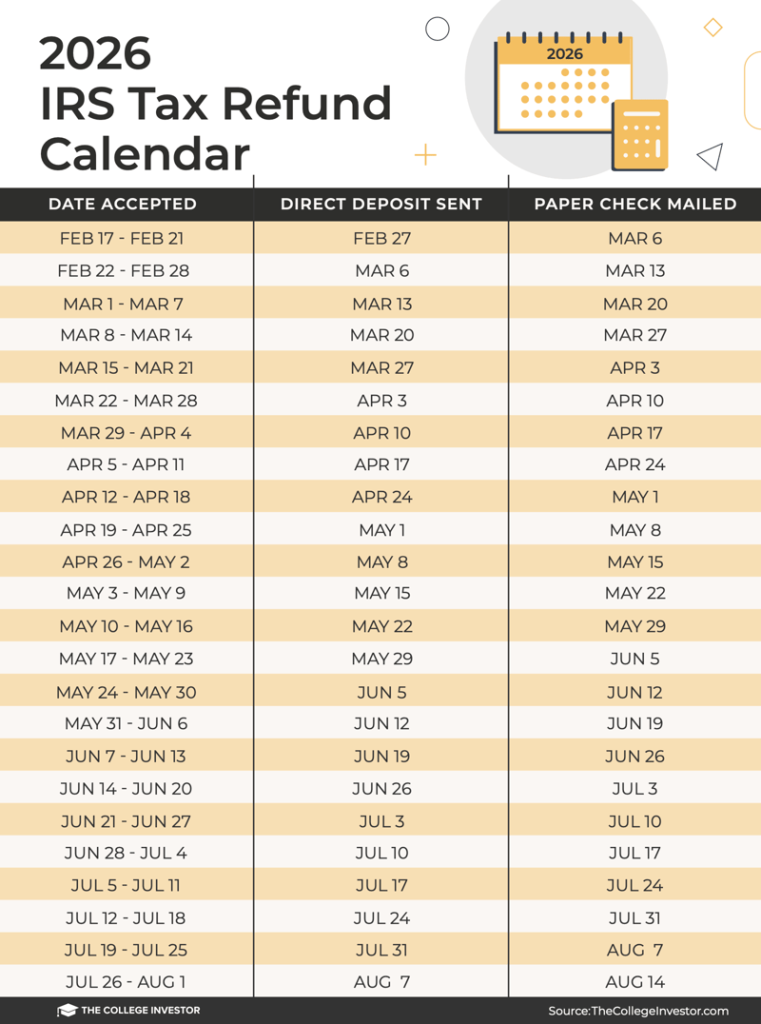

Once your refund is processed, you can choose to receive it through direct deposit or a mailed check. Direct deposit is the faster option, usually taking a few days, while a check may take a few weeks to arrive.

- Direct deposit: Quick and convenient

- Mailed check: Traditional method with longer wait times

Key Dates for the Michigan Tax Refund Schedule 2026

For taxpayers in Michigan eagerly awaiting their 2026 tax refunds, understanding the key dates for the tax refund schedule is crucial. Below are the important dates to keep in mind:

Tax Return Filing Deadline

The deadline for filing your Michigan tax return for 2026 is April 15, 2026. It is essential to submit your return on time to avoid any penalties or interest charges.

Estimated Refund Arrival

Most tax refunds are issued within 21 days of the date the return was received. However, this timeline can vary depending on various factors, including how you filed your return and if it requires further review.

Factors Affecting the Processing Time

When it comes to the Michigan tax refund schedule 2026, several factors can influence the processing time of your tax refund.

1. Filing Method

The method you choose to file your taxes can impact how quickly you receive your refund. E-filing usually results in faster processing times compared to mailing in a paper return. It is advisable to opt for e-filing for expedited processing.

2. Accuracy of Information

Ensuring that all information provided on your tax return is accurate and up-to-date is crucial for timely processing. Any errors or discrepancies can lead to delays in receiving your refund.

3. Volume of Returns

During peak tax season, the processing time may be longer due to the high volume of returns the tax department needs to handle. Expect delays during busier periods.

How to Track Your Michigan Tax Refund

If you are eagerly waiting for your michigan tax refund schedule 2026, you can track its status easily through the Michigan Department of Treasury’s online tool. The tool provides real-time updates on the processing status of your refund.

Using the Online Tool

To track your Michigan tax refund, visit the official Michigan Department of Treasury website and navigate to the refund status page. Enter your social security number, the tax year, and the refund amount to access the information.

Once you submit the required details, the system will provide you with the current status of your refund, including whether it has been processed, approved, or issued.

Checking by Phone

If you prefer to check your refund status over the phone, you can call the Michigan Department of Treasury’s automated refund hotline at 1-800-828-0109. Make sure to have your social security number and the refund amount handy for verification purposes.

Tips for a Smooth Tax Refund Process

As per the michigan tax refund schedule 2026, it’s important to file your taxes accurately and on time to ensure a hassle-free refund process. Here are some tips to help you navigate the tax refund process smoothly:

Organize Your Documents

Keep all your tax-related documents like W-2s, 1099s, and receipts in one place to avoid any missing information that could delay your refund process.

Ensure to submit correct bank account details for direct deposit of your refund as per the michigan tax refund schedule 2026.

Double-Check Your Return

Review your tax return meticulously to correct any errors or missing information to prevent processing delays.

- Check for accuracy in personal information like name and social security number.

- Verify calculations for income, deductions, and credits.

Common FAQs about Michigan Tax Refunds

Michigan taxpayers eagerly await their tax refunds each year. Here are some common FAQs to help you understand more about Michigan tax refunds for the year 2026:

When can I expect to receive my Michigan tax refund in 2026?

You can check the Michigan tax refund schedule 2026 to get an estimation of when you might receive your refund. The exact timing varies based on factors like how you filed your return and if there were any errors or audits that may delay the process.

How can I track the status of my Michigan tax refund for 2026?

You can track your Michigan tax refund online through the official Michigan Department of Treasury website. Make sure to have your social security number, filing status, and refund amount handy to access your refund status information.

Are tax refunds in Michigan taxable in 2026?

In most cases, Michigan tax refunds are not considered taxable income on your federal return. However, there may be instances where a portion of your refund is taxable, especially if you itemized deductions in previous years.

Frequently Asked Questions

- When can I expect to receive my Michigan tax refund for 2026?

- The Michigan tax refund schedule for 2026 may vary depending on various factors. It is advisable to check with the Michigan Department of Treasury for the most updated information on tax refund processing times.

- How can I track the status of my Michigan tax refund?

- You can track the status of your Michigan tax refund for the year 2026 by visiting the Michigan Department of Treasury website or by using the ‘Where’s My Refund’ tool. Make sure you have your Social Security number or Individual Taxpayer Identification Number, filing status, and exact refund amount handy to access the information.

- Are there any ways to expedite my Michigan tax refund process?

- While there is no guaranteed way to expedite the Michigan tax refund process for 2026, filing your tax return electronically and opting for direct deposit can generally speed up the refund timeline. Additionally, make sure to avoid any errors or discrepancies in your tax return to prevent delays in processing.

- What should I do if I haven’t received my Michigan tax refund within the expected time frame?

- If you haven’t received your Michigan tax refund within the expected time frame for 2026, first check the status of your refund using the online tools provided by the Michigan Department of Treasury. If you still have concerns or inquiries, you can contact the department directly for assistance.

Final Thoughts on Michigan Tax Refund Schedule 2026

As we conclude our exploration of the Michigan Tax Refund Schedule for 2026, it is important to note the key points discussed. Understanding the timeline for tax refunds in Michigan can help individuals effectively plan their finances and manage expectations. By staying informed about the schedule and possible delays, taxpayers can avoid unnecessary stress and frustration.

Remember to file your taxes accurately and on time to expedite the refund process. Keep track of important dates and deadlines to ensure a smooth tax season. Michigan residents can use the provided schedule as a valuable resource to stay updated and informed throughout the refund process.

Stay proactive, stay informed, and make the most of your tax refund in 2026!