Are you aware of the monthly child tax credit 2026 schedule and how it could benefit your family? As we navigate through the intricacies of tax regulations, understanding the specifics of the child tax credit can significantly impact your financial planning. The monthly child tax credit for 2026 offers a structured schedule that outlines when you can expect these essential payments to support the well-being of your children. By staying informed about the monthly child tax credit schedule for 2026, you can ensure timely and vital financial assistance for your family. Let’s delve deeper into this topic to help you make the most of this valuable resource.

Understanding the Monthly Child Tax Credit

The Monthly Child Tax Credit in 2026 is a crucial financial support program aimed at helping families with children. This credit provides eligible families with a set amount per child each month, contributing significantly to their overall household income.

Eligibility Criteria for Claiming

To benefit from the Monthly Child Tax Credit 2026 Schedule, families must meet certain criteria, such as having dependent children under a specific age and meeting income thresholds. It’s essential to understand these requirements to ensure you receive the credit you deserve.

Claiming Process

Families can claim the Monthly Child Tax Credit by filing the appropriate forms with the IRS. It’s crucial to provide accurate information and documentation to avoid any delays or issues in receiving the credit. Understanding the claiming process is essential to maximize your benefits.

Importance of the Child Tax Credit Schedule

The monthly child tax credit 2026 schedule plays a crucial role in providing financial assistance to families with children. By following the schedule, families can accurately plan their budgets and expenses based on the expected credit amount they will receive each month.

Ensures Regular Income

Having a predictable monthly child tax credit schedule ensures that families receive a steady stream of income to support their children’s needs, such as education, healthcare, and everyday expenses.

This regular income can provide stability and alleviate financial stress for families who rely on the child tax credit to make ends meet.

Helps in Financial Planning

By knowing the exact dates and amounts of the child tax credit payments, families can effectively plan their finances for the year 2026.

This allows them to set aside funds for specific purposes, save for the future, and make informed decisions about their spending habits.

Changes to the Child Tax Credit in 2026

As part of the new tax legislation for the year 2026, there have been significant changes to the Child Tax Credit. Families who qualify for this credit may receive a certain amount of money per child. It’s important to stay informed about these updates to ensure you are maximizing your tax benefits.

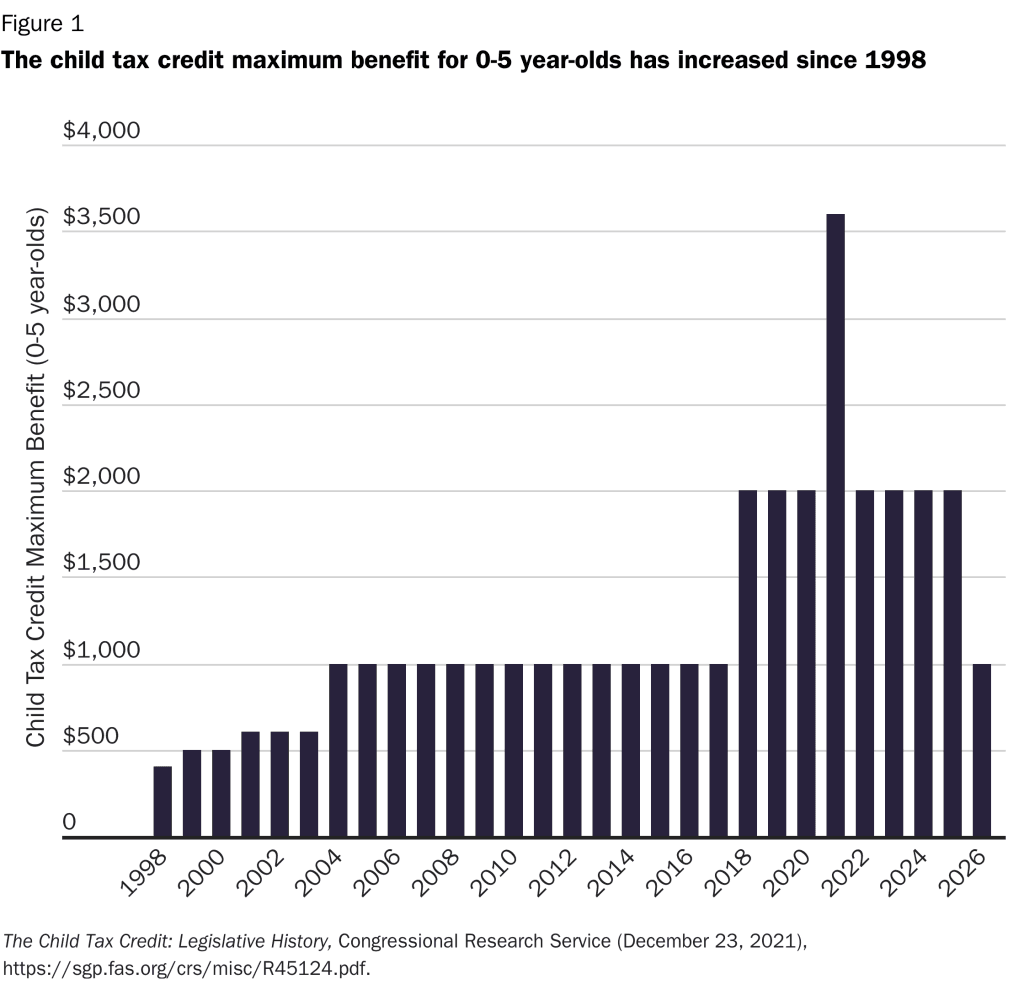

Increased Credit Amount

In 2026, the Child Tax Credit amount has been increased, providing eligible families with a higher credit per child. This change aims to support families financially and alleviate some of the financial burden of raising children.

Additionally, the monthly child tax credit 2026 schedule has been adjusted to reflect these increased amounts, offering families more financial assistance throughout the year.

Income Threshold Adjustments

The income thresholds to qualify for the Child Tax Credit have been adjusted for 2026. Families meeting specific income criteria may now be eligible for the credit, allowing more families to benefit from this financial support.

It is essential to review these updated income thresholds to determine your eligibility and take advantage of the Child Tax Credit benefits.

How to Navigate the Child Tax Credit Schedule for 2026

Understanding the monthly child tax credit 2026 schedule is crucial for parents to plan their finances effectively. The Child Tax Credit in 2026 helps eligible families by providing financial assistance to support the upbringing of their children.

Key Dates to Remember

Mark your calendars with the important deadlines related to the monthly child tax credit 2026 schedule. Being aware of these dates will ensure that you receive the maximum benefits that you are entitled to without any delays.

Calculating Your Monthly Child Tax Credit

To calculate your monthly child tax credit for 2026, consider factors such as your income, filing status, and the number of qualifying children you have. This calculation will help you estimate the amount you can expect to receive each month to support your child’s needs.

- Ensure that you provide accurate information while calculating your child tax credit for 2026.

- Consult with a tax professional if you need assistance with understanding the calculations.

Tips for Maximizing Your Child Tax Credit Benefits

Ensuring you maximize the benefits of the monthly child tax credit 2026 schedule requires careful planning. Here are some tips to make the most of this valuable financial support:

Understanding Eligibility Criteria

Before planning your finances around the child tax credit, confirm that you meet all eligibility requirements. Make sure you provide accurate information to receive the full benefits available.

Optimizing Family Information

When updating your family details for the child tax credit, remember to include any changes in dependent status or child care expenses. Providing this information accurately can increase your credit amount.

Utilizing Advance Payments Wisely

Consider how to best utilize the advanced payments received through the monthly schedule. Strategically budgeting this additional income can help cover essential expenses or contribute to your child’s future needs.

Frequently Asked Questions

- What is the monthly child tax credit?

- The monthly child tax credit is a benefit that provides eligible families with a certain amount of money each month to help with the costs of raising children.

- How does the child tax credit schedule work in 2026?

- In 2026, the child tax credit schedule determines the dates on which eligible families will receive their monthly payments. These dates are important for families to plan for their financial needs.

- What factors determine eligibility for the child tax credit in 2026?

- Eligibility for the child tax credit in 2026 is based on various factors such as income level, the number of children in the household, and the age of the children. Families must meet certain criteria to qualify for the credit.

- How can I check the child tax credit schedule for 2026?

- You can check the child tax credit schedule for 2026 on the official IRS website or through other reputable sources. It is important to stay informed about the schedule to know when to expect the payments.

- What happens if there are changes to the child tax credit schedule in 2026?

- If there are any changes to the child tax credit schedule in 2026, the IRS will typically inform the public through official channels. It is essential for eligible families to stay updated on any changes that may impact their benefits.

Wrap Up: Understanding the Monthly Child Tax Credit 2026 Schedule

In conclusion, navigating the monthly child tax credit schedule for 2026 is crucial for families to maximize their benefits. By staying informed about the payment dates and eligibility criteria, parents can ensure they receive the financial support they are entitled to. Planning ahead and budgeting around these monthly payments can help alleviate financial stress and provide much-needed assistance in covering child-related expenses.

Remember to mark your calendars and set reminders for the upcoming payment dates, and make use of online resources and tools to stay updated on any changes or updates to the schedule. By taking advantage of this valuable support, families can better secure their children’s well-being and financial stability.