Are you eagerly awaiting your refund payment for the year 2026? Understanding the refund payment schedule for 2026 is crucial for proper financial planning. In this blog, we will explore the refund payment schedule for 2026 in detail to help you anticipate when you can expect to receive your funds. With the deadline for filing taxes approaching, knowing the timeline for refund payments can alleviate any uncertainties you may have. Stay tuned as we unravel the dates and process involved in the refund payment schedule for 2026, ensuring you are well-informed and prepared for the upcoming tax season.

Introduction to Refund Payment Schedule 2026

As we delve into the refund payment schedule for the year 2026, it is crucial to understand the latest updates and timelines for receiving refunds. The refund payment schedule 2026 entails the planned dates and processes set by the authorities for issuing refunds to eligible individuals and entities.

Key Highlights of Refund Payment Schedule 2026

The refund payment schedule for 2026 outlines specific dates when refunds will be processed and disbursed to taxpayers. It is essential for individuals to be aware of these dates to ensure timely receipt of their refunds.

Electronic Deposits

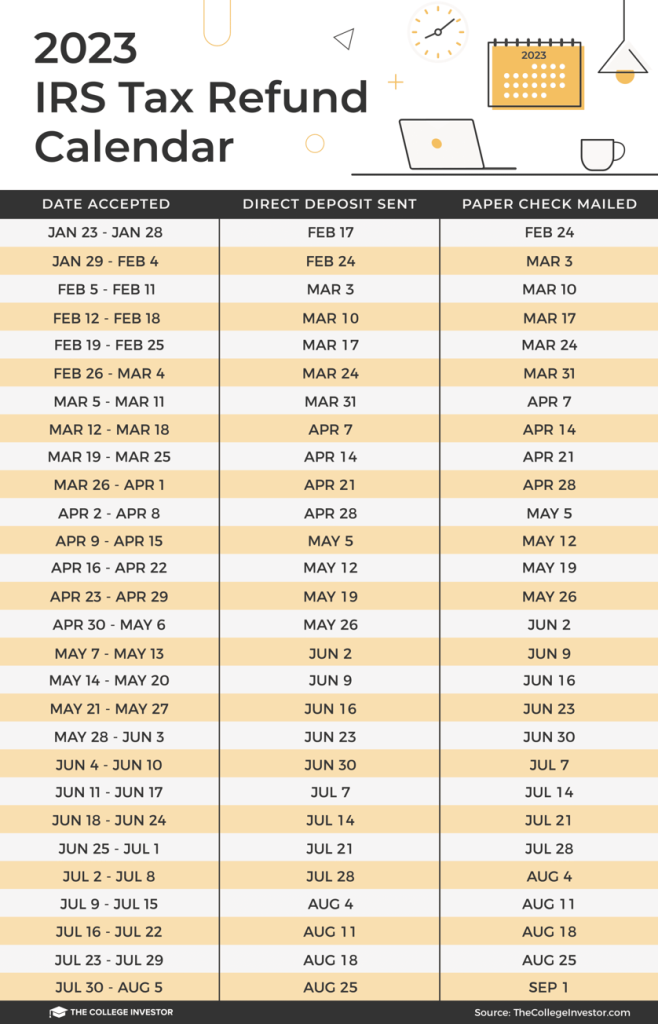

For individuals who have opted for electronic deposits, refunds are expected to be credited directly to their designated bank accounts. This method offers convenience and speed in receiving refunds.

Check Disbursements

Alternatively, individuals who have chosen to receive refunds via physical checks should expect mail deliveries within a certain timeframe according to the refund payment schedule 2026.

Importance of Adhering to the Refund Payment Schedule 2026

By following the refund payment schedule for 2026 diligently, individuals can ensure prompt processing of their refunds without unnecessary delays. Adhering to the specified timeline is crucial to avoid any complications or discrepancies in the refund disbursement process.

Consequences of Delay

Failure to adhere to the refund payment schedule may result in delays in receiving refunds, causing inconvenience and financial strain for individuals awaiting their refunds.

Understanding the Refund Process

When it comes to the refund payment schedule 2026, understanding the refund process is crucial for a smooth experience. The process of refunding a payment involves several steps to ensure that the money reaches the rightful beneficiary in a timely manner.

Initiating a Refund Request

To start the refund process, customers need to submit a refund request through the designated channels provided by the service or product provider. This could be through an online portal, email, or customer service.

Verification and Processing

Once the refund request is received, the verification process begins. This involves confirming the details of the transaction and ensuring that all criteria for a refund are met. After verification, the refund is processed within the refund payment schedule 2026.

Key Dates and Deadlines for 2026

Planning ahead is crucial when it comes to managing your finances. Here are some key dates and deadlines to remember for the refund payment schedule 2026.

January 15, 2026

Deadline for filing your tax return: Make sure to submit your tax return by this date to avoid any penalties or late fees. It’s essential to file your return accurately to receive any potential refunds on time.

March 30, 2026

Estimated Tax Payment Due: Self-employed individuals and those with additional income sources might need to make estimated tax payments by this date. Ensure you calculate and pay the correct amount to avoid underpayment penalties.

June 15, 2026

Second Estimated Tax Payment: If you are required to make quarterly estimated tax payments, remember that the second installment is due by this date. Stay on top of your tax obligations to avoid any unnecessary fines.

How to Request a Refund

When looking to request a refund for a payment made in 2026, it is essential to follow the appropriate steps to ensure a smooth process. Here is a guide on how to request a refund for the refund payment schedule 2026:

Check Refund Policy

Before initiating the refund process, it is crucial to review the refund policy of the company or service provider. Understand the terms and conditions related to refunds, including deadlines and eligibility criteria.

Initiate Refund Request

Once you have familiarized yourself with the refund policy, contact the customer support team or the designated refund department to initiate your refund request. Provide all required information and documentation to expedite the process.

- Provide payment details

- Explain the reason for the refund

- Attach any relevant supporting documents

Common FAQs about Refund Payments

Refund payment schedule 2026 is a hot topic, and with that comes various frequently asked questions regarding refund payments. Here are some common FAQs answered:

When can I expect to receive my refund payment in 2026?

In 2026, the refund payment schedule will be divided into specific timelines based on various factors such as the mode of payment, processing times, and any potential delays. It is advisable to check the official refund payment schedule for the most accurate information.

How can I track the status of my refund payment for 2026?

You can track your refund payment status through the online portal by entering your unique identification details provided during the filing process. Additionally, you may receive notifications via email or SMS regarding the status updates of your refund payment.

What should I do if there is a delay in receiving my refund payment in 2026?

If you experience a delay in receiving your refund payment in 2026, it is recommended to contact the relevant authorities responsible for processing refund payments. Provide them with your necessary details and inquire about the reasons behind the delay.

Ensuring Smooth Transactions

When it comes to managing the refund payment schedule for the year 2026, it is crucial to ensure smooth and efficient transactions to maintain customer satisfaction. One way to achieve this is by optimizing the payment processing system to expedite refunds and minimize delays.

Automate Refund Process

Implementing automated refund processes can significantly reduce manual errors and streamline the refund payment schedule. By utilizing innovative software solutions, refunds can be processed swiftly and accurately, enhancing overall efficiency.

Enhance Customer Communication

Effective communication with customers regarding their refund status and payment schedule is essential. Providing clear and timely updates can instill trust and confidence, leading to a positive customer experience.

Frequently Asked Questions

- What is the refund payment schedule for 2026?

- The refund payment schedule for 2026 outlines the dates and timelines for issuing refunds to customers or clients for specific transactions or events that took place in that year.

- How can I request a refund for a transaction in 2026?

- To request a refund for a transaction in 2026, you typically need to follow the refund policy set by the company or organization. This may involve filling out a refund request form or contacting customer service.

- Are there specific deadlines for refund requests in 2026?

- Yes, there may be specific deadlines for refund requests in 2026 as per the refund payment schedule. It’s important to adhere to these deadlines to ensure that your refund request is processed in a timely manner.

- What happens if I miss the refund request deadline for 2026?

- If you miss the refund request deadline for 2026, you may no longer be eligible for a refund or there may be additional processes or considerations involved in processing your refund request. It’s advisable to reach out to the relevant party to inquire about your options.

- Can I track the status of my refund payment in 2026?

- Tracking the status of your refund payment in 2026 may vary depending on the company or entity issuing the refund. You can usually contact customer service or check your account to get updates on the refund process.

Final Thoughts on Refund Payment Schedule 2026

As we navigate through the intricacies of the refund payment schedule for 2026, it is evident that proper planning and understanding are crucial. The detailed breakdown of the schedule provides clarity on when to expect refunds and how to manage finances accordingly. By staying informed and organized, individuals can ensure they receive their refunds in a timely manner.

Looking ahead to 2026, it is essential to mark key dates, follow the schedule diligently, and promptly address any discrepancies. This proactive approach will help streamline the refund process and minimize any potential delays or confusion. Ultimately, by adhering to the refund payment schedule 2026, individuals can maximize their financial resources and enjoy a smoother refund experience.