Planning for retirement involves understanding various aspects of social security benefits, including the Social Security schedule for 2026. As we approach the new year, it is essential to familiarize ourselves with the key dates and changes that may impact our financial planning. The Social Security Administration releases an annual schedule outlining important information such as payment dates, benefit amounts, and any updates to the program. Knowing the schedule for 2026 can help recipients and those planning for retirement stay informed and make necessary adjustments. In this blog post, we will delve into the details of the Social Security schedule for 2026 and what it means for beneficiaries.

Introduction to Social Security Schedule for 2026

As we look ahead to the social security schedule for 2026, it’s essential to understand the key changes and updates that will impact individuals relying on social security benefits. The schedule for 2026 outlines the payment dates and any adjustments to benefits that may occur based on inflation and other economic factors.

Changes in Benefit Payments

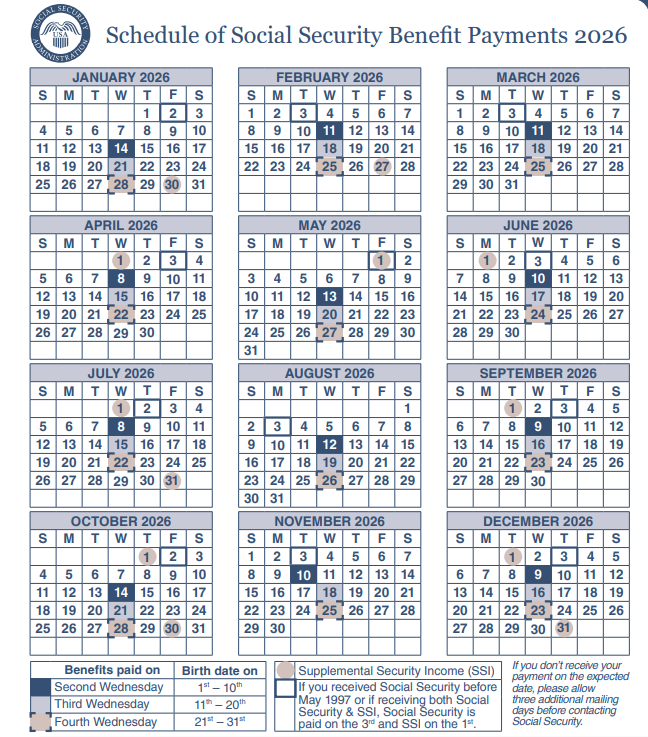

In 2026, social security recipients can expect to receive their benefits on specific dates as per the schedule. It is crucial for beneficiaries to stay informed about any changes in the payment calendar to effectively plan their finances.

It’s important to note that the Social Security Administration (SSA) regularly evaluates the cost-of-living adjustments (COLA) to ensure that benefits keep pace with inflation. Therefore, individuals may see slight changes in their payment amounts based on economic conditions.

Enhancements in Online Services

With the advancement of technology, the SSA continues to improve its online services to provide more convenience to beneficiaries. In 2026, individuals can expect enhanced digital tools for managing their social security accounts, applying for benefits, and accessing important documents.

- Improved user interface for easier navigation

- Secure online account access for confidential information

- Online calculators to estimate benefits

Changes and Updates in Social Security for 2026

As we look ahead to the Social Security schedule for 2026, it’s essential to stay informed about the latest changes and updates that may impact beneficiaries and retirees. With the new year, several adjustments are anticipated to reflect economic trends and ensure the sustainability of the program.

Cost-of-Living Adjustment (COLA)

One of the significant changes expected in 2026 is the Cost-of-Living Adjustment (COLA) for Social Security benefits. This annual adjustment aims to keep pace with inflation and maintain the purchasing power of retirees. Beneficiaries can anticipate a COLA increase that reflects the rise in the cost of living.

Maximum Taxable Earnings

Another key update for 2026 is the adjustment to the maximum taxable earnings for Social Security. This change may impact the calculations for both employees and employers, affecting the amount of Social Security tax withheld from paychecks. It’s important to consider these adjustments when planning for future income and retirement.

Impact on Different Age Groups

Understanding how the social security schedule for 2026 affects various age groups is crucial in evaluating its overall impact on the population. Let’s explore the implications for different generations:

Millennials (Born 1981–1996)

For millennials, the 2026 social security schedule brings about financial stability and retirement planning opportunities. With longer life expectancies, millennials have more years to contribute towards their social security benefits through aligning with the schedule.

Generation X (Born 1965–1980)

Generation X individuals, with many nearing retirement, will experience the direct impacts of the 2026 schedule. They may need to reassess their retirement timelines and financial strategies to optimize their benefits according to the revised schedule.

Baby Boomers (Born 1946–1964)

As the largest generation, baby boomers are at the forefront of utilizing social security benefits. The 2026 schedule may prompt them to consider postponing retirement to maximize their benefits or to explore part-time work options post-retirement to enhance their financial security.

Considerations for Retirees

Retirement planning is crucial, especially in understanding the social security schedule for 2026. Here are some key considerations for retirees to ensure a comfortable retirement:

Financial Stability

Ensuring financial stability is essential in retirement. Understand your social security benefits and how the 2026 schedule might impact your payments. Consider additional sources of income like pensions, savings, or investments to supplement your retirement funds.

Being financially prepared can help you maintain your lifestyle and cover unexpected expenses in retirement.

Healthcare Planning

Healthcare costs can be a significant expense in retirement. Evaluate your health insurance coverage options and understand how social security changes in 2026 might affect your healthcare budget.

- Review Medicare enrollment options

- Consider long-term care insurance

- Plan for potential medical expenses

Planning Ahead: Strategies for Maximizing Social Security Benefits

When it comes to maximizing your Social Security benefits in 2026, proper planning is essential. By strategizing well in advance, you can ensure you receive the maximum benefits available to you. Here are some key strategies to consider:

Start Early and Delay Benefits

One important strategy is to start planning for Social Security benefits as early as possible. By delaying your benefits, you can increase the amount you receive each month. Additionally, waiting until full retirement age or even later can further boost your benefits.

It is crucial to understand the impact of early or delayed benefits on your overall financial situation. Consulting a financial advisor can help you make the best decision based on your individual circumstances.2026

Consider Spousal Benefits

For married couples, spousal benefits can be a valuable way to maximize Social Security income. Spouses may be eligible for benefits based on their partner’s work record, which can provide additional income during retirement.

Exploring options for spousal benefits and coordinating the timing of when each partner claims benefits can optimize the total benefits received by the couple in 2026.

Frequently Asked Questions

- What changes can we expect in the Social Security schedule for 2026?

- In 2026, there might be adjustments to Social Security benefits, tax rates, and contribution limits based on inflation and economic factors.

- Will the retirement age for Social Security benefits change in 2026?

- The retirement age for Social Security benefits may gradually increase as per the existing schedule, but any significant changes would require new legislation.

- How can I find out my estimated Social Security benefits for 2026?

- You can calculate your estimated Social Security benefits for 2026 by using online calculators provided by the Social Security Administration or consulting with a financial advisor.

- Are there any proposed policy changes that may affect Social Security benefits in 2026?

- There may be proposed policy changes related to Social Security benefits in 2026, which could impact eligibility criteria, benefit amounts, and funding sources.

Final Thoughts on Social Security Schedule for 2026

Understanding the social security schedule for 2026 is crucial for individuals planning their retirement or those depending on social security benefits. With the projected changes and updates in the coming year, it’s essential to stay informed and prepared. By familiarizing yourself with the schedule, you can optimize your benefits and financial planning for the future. Remember to take note of important dates and deadlines to ensure you receive the full benefits you deserve. Stay proactive, stay informed, and make the most of the social security system in 2026.