As we step into the year 2026, it’s crucial to understand the tax schedule 2026 to effectively manage our finances and plan for the future. The tax schedule for 2026 brings about new changes and updates that taxpayers need to be aware of. Knowing the key dates, deadlines, and tax brackets outlined in the tax schedule 2026 can help individuals and businesses make informed decisions regarding their tax obligations. This blog will delve into the details of the tax schedule 2026, highlighting important information that taxpayers should be mindful of and offering insights on how to navigate the tax landscape in the upcoming year.

Introduction to Tax Schedule 2026

As we approach 2026, understanding the Tax Schedule for this year is crucial for individuals and businesses alike. Tax Schedule 2026 outlines the specific dates and deadlines for tax-related activities, including filing tax returns, making payments, and more.

Importance of Tax Schedule 2026

Having a clear understanding of Tax Schedule 2026 helps taxpayers stay organized and meet their tax obligations in a timely manner. This schedule provides valuable information on key dates and deadlines, preventing last-minute rushes and potential penalties.

Key Dates to Remember

• Tax Return Filing Deadline: April 15, 2026

• Tax Payment Deadline: June 15, 2026

• Quarterly Estimated Tax Payment Due: September 15, 2026

• Extension Request Deadline: October 15, 2026

Understanding the Changes in Tax Laws

Keeping up with the tax schedule 2026 involves understanding the significant changes in tax laws introduced this year. Whether it’s alterations in tax brackets, deductions, or credits, being aware of these changes is crucial for accurate tax filing.

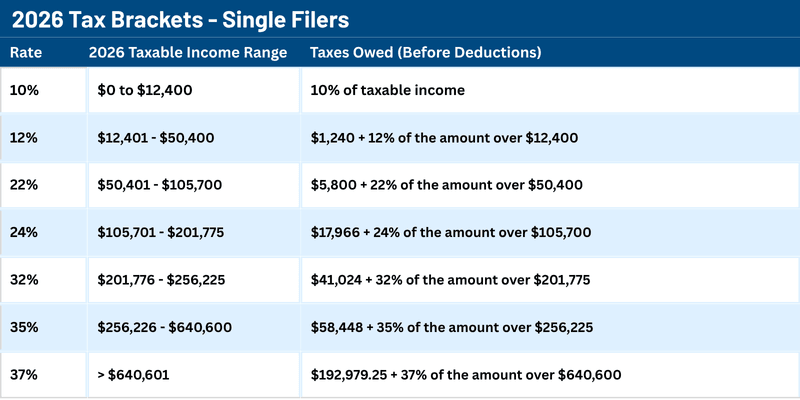

Key Changes in Tax Brackets

For the tax schedule 2026, there have been adjustments in income thresholds for various tax brackets. Taxpayers need to be mindful of these changes to ensure they are correctly taxed based on their income level.

Understanding how the tax brackets have shifted can help individuals plan their finances effectively.

Updated Deductions and Credits

Alterations in deductions and credits can impact your tax liability. Staying informed about the newly introduced deductions and credits in 2026 can help taxpayers maximize their savings.

- Educational credits

- Healthcare deductions

- Retirement savings benefits

Key Updates in the Tax Schedule 2026

As we delve into the tax schedule of 2026, several key updates come to light, impacting taxpayers and the financial landscape. Let’s explore the significant changes that individuals and businesses need to be aware of for the upcoming fiscal year.

New Tax Brackets Implemented

The tax schedule for 2026 introduces revised tax brackets, affecting how income is taxed based on different income levels. Taxpayers will need to review these changes to understand how they might be placed in a new bracket, potentially altering their tax liabilities.

Additionally, individuals falling into higher-income brackets may face increased tax rates, emphasizing the importance of strategic tax planning and financial management.

Expansion of Deductible Expenses

In a bid to support specific industries and encourage certain behaviors, the tax schedule for 2026 includes an expansion of deductible expenses. Taxpayers may now benefit from additional deductions related to investments, educational expenses, and sustainable practices.

- Investment-related deductions

- Educational expense deductions

- Green energy incentives

Implications for Taxpayers

As taxpayers look ahead to the tax schedule 2026, there are several key implications to consider. The changes in tax policies and rates can directly impact individuals and businesses alike.

Tax Rate Adjustments

With the upcoming tax schedule 2026, taxpayers may experience fluctuations in tax rates that could influence their overall tax liability. It is crucial for taxpayers to stay informed about any changes to ensure proper tax planning.

Understanding how these adjustments affect different income brackets is essential for accurate financial planning and compliance.

Updated Deductions and Credits

Revisions to deductions and credits in the tax schedule 2026 can have a significant impact on individual tax returns. Taxpayers should stay updated with the latest information to maximize their tax savings.

- Exploring new deductions and credits can help reduce taxable income.

- Being aware of changes to existing credits can prevent missed opportunities for tax savings.

Strategies for Adapting to the New Tax Schedule

As we move into the tax schedule 2026, it’s crucial for individuals and businesses to adapt their strategies accordingly to navigate the changes effectively.

Stay Informed and Plan Ahead

Stay updated with the latest tax regulations and changes for 2026. Planning ahead can help you anticipate any potential impact on your finances.

Consult with tax professionals early in the year to assess your situation and make necessary adjustments.

Maximize Deductions and Credits

Take advantage of all available deductions and tax credits to reduce your tax liability. This could include charitable contributions, education expenses, or retirement contributions.

Keep track of receipts and documentation to support your claims and ensure compliance with the new tax rules for 2026.

Case Studies and Examples

Exploring real-life case studies and examples can provide valuable insights into understanding the tax schedule 2026 and its implications on different scenarios.

Case Study 1: Individual Taxpayer

For instance, John, a single taxpayer in 2026, utilized tax schedule 2026 to manage his income tax liability effectively. He successfully optimized his tax payments using the latest tax brackets.

Case Study 2: Small Business

A small business, XYZ Inc., leveraged the tax schedule 2026 to strategize their quarterly tax payments in alignment with the current rates. They streamlined their financial planning to maximize tax savings.

- Researched tax deductions

- Implemented strategic tax planning

- Ensured compliance with 2026 tax laws

Resources for Further Information on Tax Schedule 2026

For detailed insights on Tax Schedule 2026, individuals can refer to the official government website’s Tax Department section. Here, taxpayers can find comprehensive information regarding tax rates, deadlines, deductions, and exemptions applicable in 2026.

1. Government Tax Websites

The official tax websites provide detailed information on Tax Schedule 2026, including downloadable forms, guides, and FAQs to assist taxpayers in understanding their tax obligations for the year.

Moreover, online tax calculators available on these websites offer an easy way for individuals to estimate their tax liabilities accurately.

2. Tax Consultants and Professionals

Consulting tax professionals or financial advisors can offer personalized guidance tailored to individual circumstances. These experts can provide insights on tax planning strategies, exemptions, and credits available under the Tax Schedule 2026.

- Seeking advice from certified tax professionals ensures compliance with tax laws and maximizes potential savings.

- Consulting with a tax expert can help individuals navigate complex tax regulations and optimize their tax returns efficiently.

Frequently Asked Questions

- What is the tax schedule for 2026?

- The tax schedule for 2026 refers to the specific tax rates and brackets set by the government for that year.

- How is the tax schedule determined for 2026?

- The tax schedule for 2026 is typically determined based on various economic factors, tax laws, and government policies in place at that time.

- What changes can we expect in the tax schedule for 2026?

- Changes in the tax schedule for 2026 could include adjustments to tax rates, income brackets, deductions, and credits depending on the economic outlook and government priorities.

- When will the tax schedule for 2026 be announced?

- The tax schedule for 2026 is usually announced by the government well in advance, often towards the end of the preceding year or at the beginning of the tax year.

- How can individuals and businesses prepare for the tax schedule in 2026?

- To prepare for the tax schedule in 2026, individuals and businesses can stay informed about any proposed changes, review their financial situations, and seek advice from tax professionals.

Final Thoughts on Tax Schedule 2026

As we navigate through the intricacies of the tax schedule 2026, it becomes evident that being informed and proactive is key to managing our finances effectively. Understanding the changes in tax regulations and how they impact our financial planning is crucial for making informed decisions. By staying updated on the tax schedule 2026, individuals and businesses can optimize their tax strategies and ensure compliance with the latest laws. Remember, proper tax planning can lead to significant savings and potential financial growth in the long run. Embrace the opportunities presented by the tax schedule 2026 to secure a stable financial future.