Stay informed about the latest tax schedules that will impact your financial planning in 2026. Understanding the tax schedules for the upcoming year is essential for both individuals and businesses to make strategic decisions and optimize their tax obligations. In this blog, we will delve into the key changes and updates in the tax schedules for 2026, exploring how they could influence your tax liabilities and savings opportunities. Whether you are preparing for tax season or simply interested in staying updated on tax regulations, this comprehensive guide to tax schedules 2026 will provide you with the insights you need to navigate the ever-evolving tax landscape.

Introduction to Tax Schedules 2026

As we step into the tax year 2026, understanding the intricacies of tax schedules becomes crucial for individuals and businesses. Tax schedules for 2026 outline the various tax rates, deductions, and credits applicable for the year, shaping how taxpayers calculate their liabilities and refunds.

Importance of Tax Schedules 2026

With tax laws evolving each year, staying informed about the latest tax schedules ensures compliance and maximization of tax benefits. Tax schedules provide a structured framework for taxpayers to organize their financial information and determine their tax obligations accurately.

Key Components of Tax Schedules 2026

The tax schedules for 2026 encompass various sections, including income brackets, capital gains rates, and deductions for specific expenses. Understanding these components is essential for efficient tax planning, helping individuals and businesses optimize their tax outcomes.

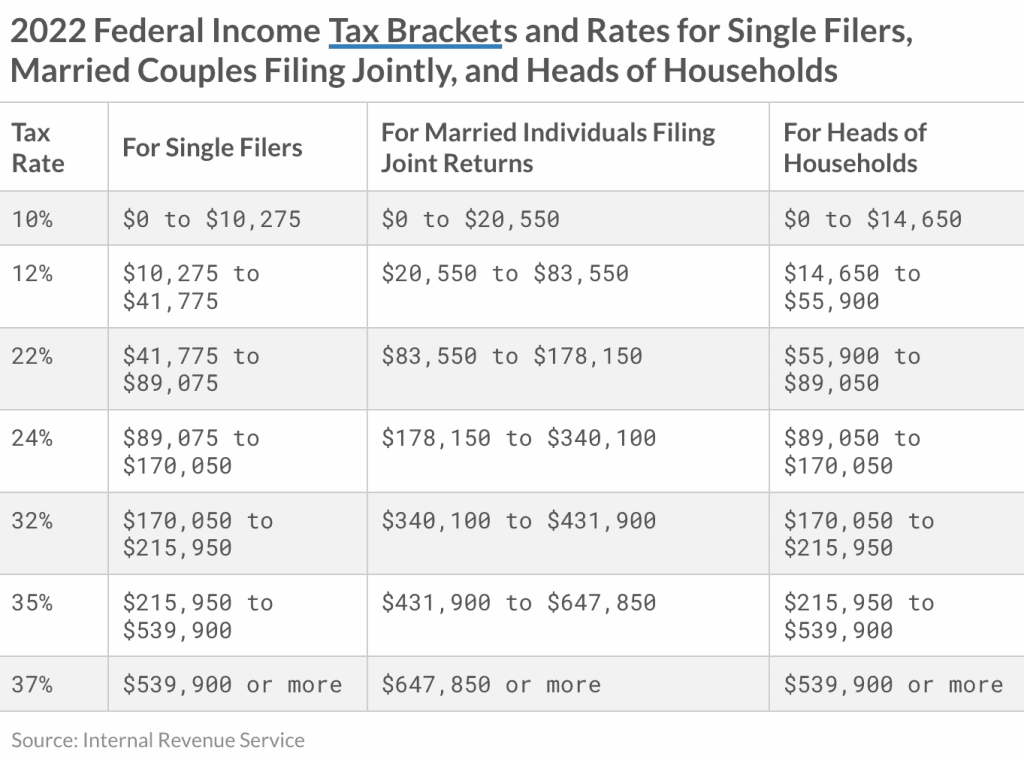

- Income Brackets: Define the taxable income ranges and corresponding tax rates applied.

- Deductions: Include deductions for expenses such as mortgage interest, medical costs, and charitable contributions.

- Credits: Offer opportunities to lower tax liabilities directly, providing dollar-for-dollar savings.

Understanding the Changes in Tax Schedules

Tax schedules for the year 2026 are set to undergo significant changes, affecting both individuals and businesses. Keeping abreast of these modifications is crucial for proper financial planning and compliance.

Shifts in Tax Rates

One of the key aspects of tax schedules 2026 is the alterations in tax rates. Taxpayers need to be aware of the revised rates to accurately calculate their tax liabilities. Being informed is the first step towards minimizing tax burdens.

Updated Deductions and Credits

Changes in deductions and credits can have a direct impact on taxable income. Staying updated on available tax breaks for the year 2026 is essential for maximizing savings. Utilizing all eligible deductions can lead to substantial tax savings.

Impact of Tax Schedules 2026 on Individuals

In 2026, the tax schedules are set to have a significant impact on individuals’ financial planning. Understanding the changes and how they affect personal finances is crucial for proper tax management.

Changes in Tax Brackets

The tax brackets for 2026 may see adjustments, impacting the amount of income taxed at different rates. Individuals need to be aware of these changes to plan their finances effectively.

Updated Deductions and Credits

2026 introduces new deductions and credits that individuals can leverage to reduce their tax liabilities. Keeping track of these opportunities is essential for maximizing savings.

Implications for Small Businesses

As we approach the tax schedules of 2026, small businesses need to be aware of the potential impacts on their financial strategies and operations. Understanding the changes in tax regulations can help businesses make informed decisions to maximize profitability and compliance.

Adaptation to New Tax Rates

Small businesses must be prepared to adapt to any fluctuations in tax rates set for 2026. It’s essential to stay updated with the latest tax schedules to adjust financial planning accordingly.

Business owners may need to consult with tax advisors to ensure they are complying with the new rates and taking advantage of any available deductions effectively.

Utilizing Tax Credits and Incentives

Exploring tax credits and incentives can be advantageous for small businesses to reduce their tax liabilities. In 2026, certain credits may be introduced or amended, providing opportunities for businesses to save on taxes.

- Research and identify applicable tax credits

- Leverage incentives for business growth

- Keep track of eligibility criteria

Strategies to Navigate Tax Schedules Changes

Keeping up with tax schedule changes is crucial for financial planning in tax schedules 2026. To navigate these changes effectively, individuals and businesses can consider the following strategies:

Regularly Monitor Updates

Stay informed about tax schedule modifications by subscribing to reliable financial news sources or consulting with tax professionals.

It is essential to track the latest adjustments to avoid any surprises during tax filing season.

Adjust Financial Strategies Accordingly

Once aware of the changes, review your financial strategies and make necessary adjustments to optimize tax savings or minimize liabilities.

- Consider tax-advantaged investment options for tax schedules 2026.

- Explore tax deductions and credits that align with the current schedules.

Case Studies on Tax Schedules 2026

As we delve into the intricate world of tax schedules for the year 2026, it is crucial to analyze real-life case studies to gain a comprehensive understanding of how these schedules impact businesses and individuals alike.

Impact of Revised Tax Schedules

One prominent case study involves a medium-sized business that witnessed a significant reduction in tax liabilities after the implementation of the revised tax schedules in 2026. This reduction allowed the company to invest more in research and development, thereby fostering innovation.

Challenges Faced by Taxpayers

Another case study highlights the challenges faced by individual taxpayers due to the complexities of the new tax schedules for 2026. Many individuals struggled to navigate through the updated regulations, leading to potential errors in filing their returns.

- Understanding the nuanced changes in tax brackets

- Adapting to new deduction limits

- Complying with enhanced reporting requirements

Frequently Asked Questions

- What are tax schedules for 2026?

- Tax schedules for 2026 outline the rates at which individuals and businesses will be taxed for that year. These schedules can detail various tax brackets and rates based on income levels.

- How do tax schedules for 2026 differ from previous years?

- Tax schedules for 2026 may differ from previous years due to changes in tax laws, rates, and brackets. It’s important to stay updated on the latest tax schedules to understand how they impact your tax obligations.

- Where can I find the tax schedules for 2026?

- The tax schedules for 2026 can typically be found on official government websites, tax authority platforms, or through tax preparation software. You can also consult tax professionals for assistance in accessing and understanding these schedules.

- How do tax schedules for 2026 affect individuals and businesses?

- Tax schedules for 2026 can impact individuals and businesses by determining how much they owe in taxes based on their income levels. Understanding these schedules is crucial for proper tax planning and compliance.

Final Thoughts on Tax Schedules 2026

As we delve into the intricacies of tax schedules for 2026, it’s evident that staying informed and proactive is key to navigating the ever-evolving tax landscape. Understanding the changes in tax brackets, deductions, and credits can significantly impact your financial planning and decision-making. Remember to consult with a tax professional or use reliable software to ensure accuracy and compliance with the latest regulations. By optimizing your tax strategies based on the 2026 schedules, you can maximize savings and minimize liabilities. Stay updated on any future tax updates to adapt your financial approach accordingly.