One of the most awaited times of the year for many individuals is tax season and the anticipation of receiving a tax refund. Understanding the 2026 tax refund schedule chart is crucial in planning and managing your finances effectively. In this comprehensive guide, we delve into the intricacies of the 2026 tax refund schedule chart, providing you with valuable insights on when to expect your refund based on various factors.

By exploring the 2026 tax refund schedule chart, you can gain clarity on the processing timelines, potential delays, and tips to expedite your refund. Stay tuned as we break down the essential information you need to optimize your tax refund experience in 2026.

IRS Income Tax Refund Schedule for 2025- This chart can help you estimate when you should get your 2025 income tax return, based on when you file and a few other easy factors.- https://t.co/RYobzuGUhU

— CPA Practice Advisor (@cpapracadvisor) February 10, 2025

Understanding the 2026 Tax Refund Schedule

As taxpayers gear up for the 2026 tax season, having a clear understanding of the 2026 tax refund schedule chart is crucial. The schedule outlines the timeline for when taxpayers can expect to receive their refunds based on when they filed their returns and the method of payment they chose. This information is essential for financial planning and budgeting.

2026 Tax Refund Schedule Chart Overview

The 2026 tax refund schedule chart provides a detailed breakdown of the anticipated timeline for refund disbursement. It typically includes the start date for tax filing, estimated refund processing times, and key dates for different filing methods. Taxpayers can refer to this schedule to track the status of their refunds and manage their finances accordingly.

Understanding the intricacies of the 2026 tax refund schedule chart can help taxpayers avoid unnecessary delays and stay informed about the progress of their refunds.

Key Factors Affecting Refund Processing

Several factors can influence the processing time of tax refunds in 2026. These factors may include the accuracy of the information provided on the tax return, any errors or discrepancies that need to be resolved, and the method of payment selected by the taxpayer.

- Accuracy of Information: Providing correct and complete information on the tax return can expedite the refund process.

- Errors and Discrepancies: Any errors or discrepancies identified during the review process may delay the refund.

- Payment Method: Choosing direct deposit can result in faster refund disbursement compared to a mailed check.

Significance of Having a Detailed Chart

Having a detailed chart of the 2026 tax refund schedule is crucial for taxpayers to plan their finances effectively and make informed decisions. The schedule provides a clear overview of when to expect refunds, allowing individuals to budget and allocate funds accordingly.

Accurate Prediction of Refund Dates

By referring to the detailed chart, taxpayers can accurately predict the dates they are likely to receive their refunds. This information is valuable for managing cash flow and addressing any pending financial obligations.

Moreover, understanding the refund schedule helps individuals avoid unnecessary financial stress by knowing when to expect the funds to arrive.

Optimizing Financial Planning

With a comprehensive chart at hand, taxpayers can optimize their financial planning by strategizing how to utilize the refund amount efficiently. Whether it is debt repayment, savings, or investment opportunities, having a clear timeline enhances financial decision-making.

- Creating a budget based on the expected refund date

- Allocating funds for specific expenses or savings goals

- Seizing investment opportunities at the right time

Key Dates and Deadlines in the 2026 Tax Refund Schedule

As we delve into the 2026 tax season, it’s crucial to stay informed about the key dates and deadlines in the 2026 tax refund schedule chart.

Opening of Tax Filing Season

The tax filing season for 2026 is set to begin on January 24th. Taxpayers can start submitting their tax returns, including for refunds.

Deadline for Filing Tax Returns

The deadline for filing tax returns for 2026 is April 15th. It is essential to file your taxes by this date to avoid any penalties or interest charges.

Expected Refund Date

For those expecting a refund, the IRS typically issues refunds within 21 days of receiving a tax return. Therefore, if you file your taxes early, you can expect your refund by mid-February or early March.

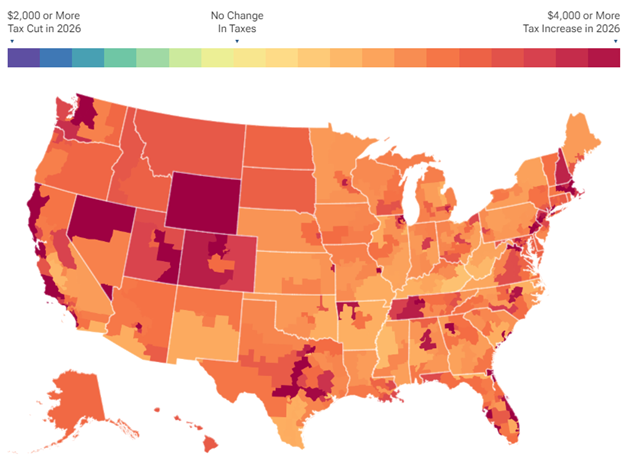

Image for Reference

Tips for Maximizing Your Tax Refund

When aiming to maximize your tax refund for the 2026 tax year, there are several strategies you can implement. By following these tips, you can ensure that you receive the maximum refund you are entitled to.

1. Keep Detailed Records

Keeping detailed records of your expenses and income throughout the year can help you identify all possible deductions and credits you may be eligible for. Utilize tools like expense tracking apps to make this process easier and more organized.

2. Contribute to Retirement Accounts

Contributing to retirement accounts such as IRAs or 401(k)s can not only help you save for the future but also lower your taxable income, potentially increasing your tax refund. Consult a financial advisor to determine the best retirement savings strategy for your situation.

3. Take Advantage of Tax Credits

Make sure to claim all applicable tax credits, such as the Earned Income Tax Credit or the Child Tax Credit, to reduce your tax liability and increase your refund amount. Familiarize yourself with the eligibility criteria for each credit to maximize your benefits.

Common Questions About the 2026 Tax Refund Schedule

As taxpayers eagerly await their 2026 tax refunds, many questions arise regarding the tax refund schedule chart. Understanding the timeline and process is crucial for financial planning. Here are some common queries:

When Will I Receive My Tax Refund in 2026?

Individuals wonder about the expected timeline for receiving their tax refunds in 2026. The IRS typically processes refunds within 21 days for electronically filed returns. However, factors such as refund method and any discrepancies may affect the schedule.

How Can I Track My Refund Status?

Tracking your tax refund status is essential for monitoring the progress of your return. The IRS provides an online tool, “Where’s My Refund?”, which allows taxpayers to track their refunds by entering basic information like Social Security number and filing status.

If you prefer, you can also use the IRS2Go mobile app to check the status of your refund on the go.

What Factors Can Delay My Tax Refund?

Several factors can potentially delay your tax refund in 2026. Common reasons include incomplete or inaccurate information on tax returns, identity theft concerns, claims for the Earned Income Tax Credit or Additional Child Tax Credit, or if the return needs further review.

Frequently Asked Questions

- What is the purpose of the 2026 Tax Refund Schedule Chart?

- The 2026 Tax Refund Schedule Chart provides a comprehensive guide on when taxpayers can expect to receive their tax refunds for the year 2026. It outlines the different timelines and schedules for processing tax returns and issuing refunds by the IRS.

- How can I use the 2026 Tax Refund Schedule Chart to track my tax refund?

- You can use the 2026 Tax Refund Schedule Chart to estimate when you might receive your tax refund based on when you filed your tax return. By referencing the chart, you can have a general idea of the timing of your refund.

- Is the 2026 Tax Refund Schedule Chart the same every year?

- No, the Tax Refund Schedule Chart can vary from year to year based on factors such as changes in tax laws, IRS processing times, and other external circumstances. It is important to refer to the specific chart for each tax year.

- Where can I find the 2026 Tax Refund Schedule Chart?

- The 2026 Tax Refund Schedule Chart can typically be found on the IRS website or through reputable tax preparation websites. It is important to use a reliable and up-to-date source for the most accurate information.

- Are there any tips for maximizing my tax refund for 2026?

- To maximize your tax refund for the year 2026, you can consider taking advantage of deductions, credits, and other tax-saving strategies. Consulting with a tax professional can also help ensure you are optimizing your tax refund.

Unlock the 2026 Tax Refund Schedule Chart: Concluding Insights

In concluding our comprehensive guide on the 2026 tax refund schedule chart, we have delved into the intricacies of tax refunds and provided a clear roadmap for taxpayers in the upcoming year. Understanding the timeline and factors influencing your refund can empower you to better manage your finances and plan ahead. Remember to file your taxes early and accurately to expedite the refund process.

By staying informed and utilizing the 2026 tax refund schedule chart to your advantage, you can maximize your refund and minimize any potential delays. Take control of your financial future by leveraging this valuable resource and ensure a smooth tax season in the year ahead.